Table of Contents

What is user feedback?

User feedback is qualitative and quantitative data from customers on their likes, dislikes, impressions, and requests about a product. Collecting and making sense of user feedback is critical for businesses that wish to make improvements based on what their users need. Channels for user feedback can include email and phone surveys, as well as third party research, but the most reliable responsive channel for user feedback is delivered by in-app messaging and in-product surveys.

It can also be beneficial to create a feedback portal within the product itself. After Kajabi implemented a portal where users could submit feature requests and vote on those submitted by others, the team saw thousands of users engage with it. These requests helped the team better understand what their users needed from the product.

Why is user feedback important?

When you live and breathe your product, it can be hard to put yourself in the shoes of an everyday user. Collecting user feedback allows you to step back and see your product with fresh eyes. It helps you understand what your users think and feel when they use your product, builds empathy for their experiences, and gives you actionable insight into what’s working well—or not so well. User feedback helps you answer questions like:

- What do our users think of X product or Y feature? Why?

- What requests or issues keep surfacing repeatedly? How can we address them?

- Where do we have gaps in our product experience?

Asking for feedback is also a great way to show your users and customers that you value what they have to say, which fosters loyalty and trust (just be sure to close the loop). And as you start identifying trends in your users’ feedback, you’ll be able to iterate with confidence.

User feedback is also important in an internal-facing context. When the product in question is software you’ve purchased and the users are your own employees, it’s important to gauge sentiment and solicit comments about how smooth the onboarding process is, how prevalent new feature adoption is, and how comfortable your team is using apps overall. Doing so will help you make the right decisions to optimize your digital adoption plan.

What are the different types of user feedback?

- NPS: Net Promoter Score is a structured way to sort customers into Promoters, Passives, and Detractors based on their 0-10 point rating for the question “How likely are you to recommend this product to a friend or colleague?”

- CSAT: Customer satisfaction rating, typically administered after an interaction with support staff or other transactional events.

- Feature requests: Customer feedback on feature enhancements or desired functionality is a key way to assess market demand and learn what to build next.

- Release feedback: After the product team has shipped a new product or feature, collecting post-launch feedback is an important way to learn if the offering hit the mark or if there’s more work to be done.

How do I collect user feedback?

There are many approaches and methodologies for collecting user feedback. In an ideal world, the why, how, and where of your feedback-gathering approach should be part of a broader Voice of the Customer (VoC) program, but it’s okay to start small. Here are a few tactics you can leverage to engage with your users:

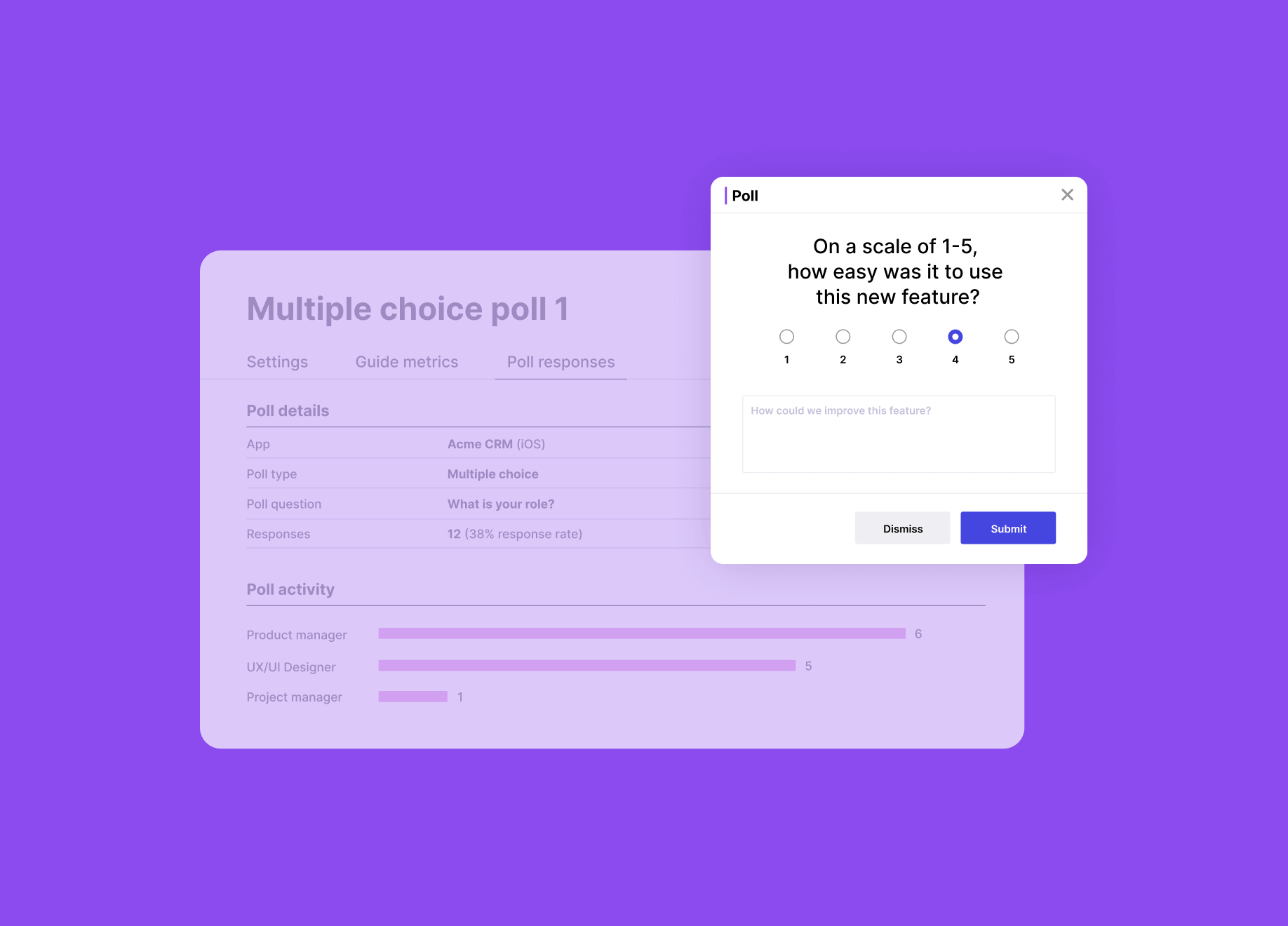

- In-app messaging / surveys: As the name implies, these requests for feedback are deployed within your application. Asking for your users’ feedback while they’re actually using your product means you’re capturing their real-time, contextual sentiment. This is a great way to field rating scale-type questions (more on that below).

- Pulse surveys: Brief, periodic surveys sent to your users or a subset of users. Pulse surveys can be deployed via email, social media, or any other platforms your users utilize regularly. The beauty of pulse surveys is that they allow you to track sentiment over time, at consistent intervals. Try to have at least one quantitative measure as part of your pulse survey so you can easily spot trends and fluctuations.

- User testing: There is an entire school of thought on user testing approaches. But when it comes to your product, it can be incredibly valuable to simply observe a user interacting with it. You’ll quickly get a sense of which areas of your product are intuitive vs. not, and you’ll witness first-hand where your users are getting stuck vs. where they’re good to go. The lesson also applies to software you’ve purchased for your teams to use. Getting a good sense of pain points and blockers will help optimize the onboarding process and limit the friction employees experience within and across apps.

- User interviews: Conducting one-on-one interviews with your users allows you to capture their candid, unfiltered feedback at the individual level. While interviews are generally labor and time-intensive, they can be a valuable source of qualitative feedback (and verbatim quotes) that might otherwise get lost when data is evaluated in aggregate.

- Focus groups: Focus groups allow you to bring a smaller cohort of users together for an open discussion about their experiences with your product. While they can also be an insightful source of qualitative feedback, be wary of groupthink and how it may sway the discussion or color your users’ sentiment.

- Feedback capture and prioritization tool: Having a dedicated place on your website or within your product where people can voluntarily submit feedback and product requests is a great way to show your users that they’re at the heart of your product. And for product owners, it’s a great way to manage all that incoming feedback in a single place—ultimately empowering you to make informed decisions. Check out how Pendo Feedback does it here. Taking a similar approach for your employees empowers you to make the right choices to optimize their experience while letting your team know their thoughts and concerns aren’t going unaddressed.

What question formats can I use to solicit feedback?

- Picklist: The user chooses one option from a pre-selected list. This is usually delivered as a drop-down menu or a radio button. Examples include “What’s your industry?” or “What’s your role?”

- Multi-select: This question format allows the user to select more than one option for their answer. It is typically administered in a “check all that apply” type of question. Examples include “Which features would you be interested in testing?” or “What departments at your organization use this solution?”

- Rating scale: This question is useful for getting quantitative information for releases or sentiment rating. Formats include NPS (0-10 rating), Likert scale (“On a scale from 1-7, how much do you agree with the following statements?”), 5-star rating (1-5 scale), or even a binary thumbs up/thumbs down rating.

- Open text: This question format is an effective addition to quantitative rating scales, and can be helpful to understand the “why” behind any individual number rating. Ask users to provide detail on why they gave their previous quantitative rating.

When should I collect user feedback?

If you have tools and processes in place to capture both active and passive feedback, chances are you’ll always have a steady stream of requests coming your way. When it comes to proactively reaching out to users for feedback, it’s important to understand your product’s specific user journey so you don’t come across as disconnected, callous, or (worst of all) spammy. The same is true in the case of software you purchase for your employees to use. Here are a few examples of when asking for feedback is a good idea:

- During pilots / testing / beta: You know your product better than anyone, which is why it’s important to hear what your users (who don’t know your product) think. If your users have already agreed to be part of your testing initiatives, don’t be shy to solicit their input.

- Immediately after onboarding: Ask your customers or new hires how easy or difficult it was for them to get up and running. Did they get stuck at any point? Was anything confusing? Where did they need additional guidance? These findings will ultimately help you improve the set-up process for future users.

- Following completion of a task or transaction: If your user just completed a task or transaction, it’s a great time to ask them about their experience using your product. If things went smoothly, they’ll be more willing to share their positive experience. And if things didn’t go so smoothly, they’ll be itching to tell someone about it.

- After getting help: This is a great opportunity to find out how satisfied your users are with your supplemental resources or support teams. You’ll learn how your support organization is doing, and maybe even uncover themes that indicate gaps or opportunities for improvement within your product.

- When a user upgrades or downgrades their account: If a user moves from a free to paid version of your product (or vice versa), it’s helpful to understand their drivers. What motivated them to make the move? What problems are they trying to solve? This information could help you identify new use cases and business needs that impact your product roadmap.

- When your users aren’t using features: If your users aren’t adopting particular features in your product, or employees aren’t doing the same for software you’ve purchased, it’s important to understand why. Ask these users what’s blocking or hindering them—and use their feedback to iterate and improve.

And of course, let your users come to you! Having an always-available place users can go to submit their product requests signals that you value their input. Make sure your feedback request form or tool is easy to find, and create a Product Feedback Policy so your users know what to expect when they hit “Submit.”

You might also like