The difference between active and passive customer feedback (and why you need both)

They say feedback is a gift–hearing what your customers think about and need from your product is absolutely critical to ensuring your team is building the right things. While I don’t disagree with this sentiment, it’s important to think about how the gift of feedback can (and should) be delivered.

Beyond simply gathering feedback when it’s convenient, teams (product and beyond) need a thoughtful strategy around feedback collection: how they will collect it, where this feedback will live, and how it will make its way to the product team. A key first step is determining the types of feedback to collect, and one way to think about it is to separate active and passive feedback.

Active feedback: Ask and you shall (hopefully) receive

Active feedback is when a company directly asks for feedback from its customers. This is especially useful for gathering feedback on specific product releases or updates, and is often measured over time to assess progress.

Here are some examples of active feedback to consider utilizing in your strategy:

NPS

Net Promoter Score surveys ask users to rate how likely they are to recommend a brand to a friend or colleague from 0 to 10. A score is calculated by subtracting the percentage of Detractors (those who rate 0 through 6) from the percentage of Promoters (those who rate 9 or 10). You can deploy these surveys in a variety of ways (e.g. via email, a popup on your website, SMS) but serving them in-app tends to elicit the highest response rate. When it comes to NPS, the value comes from tracking it over time to see how sentiment changes (ideally, you’ll see it increase as you work to improve your product).

CSAT

A customer satisfaction score measures customer service and/or product quality, expressed as a percentage from 0 to 100. The single-question survey asks some variation of, “How would you rate your overall satisfaction with the [product/service] you received?” and users respond from 1 (‘Very unsatisfied’) to 5 (‘Very satisfied’). Similar to NPS, it’s useful to track CSAT over time and be as consistent with measurement as possible.

User interviews and focus groups

While getting feedback in-product is convenient, sometimes you need to talk with your customers directly. User interviews and focus groups allow your team to gain a deeper understanding of users’ needs, use cases, and behavior, helping add context to other feedback tactics like NPS surveys and in-app feedback.

Polls and surveys

In-app polls and surveys can be leveraged for a variety of reasons. For example, you might want to create an in-app survey for new users to fill out after onboarding, or create a one-question survey that users fill out after their support case is closed. With polls, it’s best to stick to simple yes/no questions, like asking, “Do you think this feature will be useful to you?” for a newly-released feature.

Passive feedback: Make feedback collection always-on

Rather than companies asking their customers directly, passive feedback refers to feedback that is instigated by the customers themselves. You can think of these as “always-on” methods for collecting customer feedback–they are available to users to utilize when the time is right.

Here are four types of active feedback that companies often leverage:

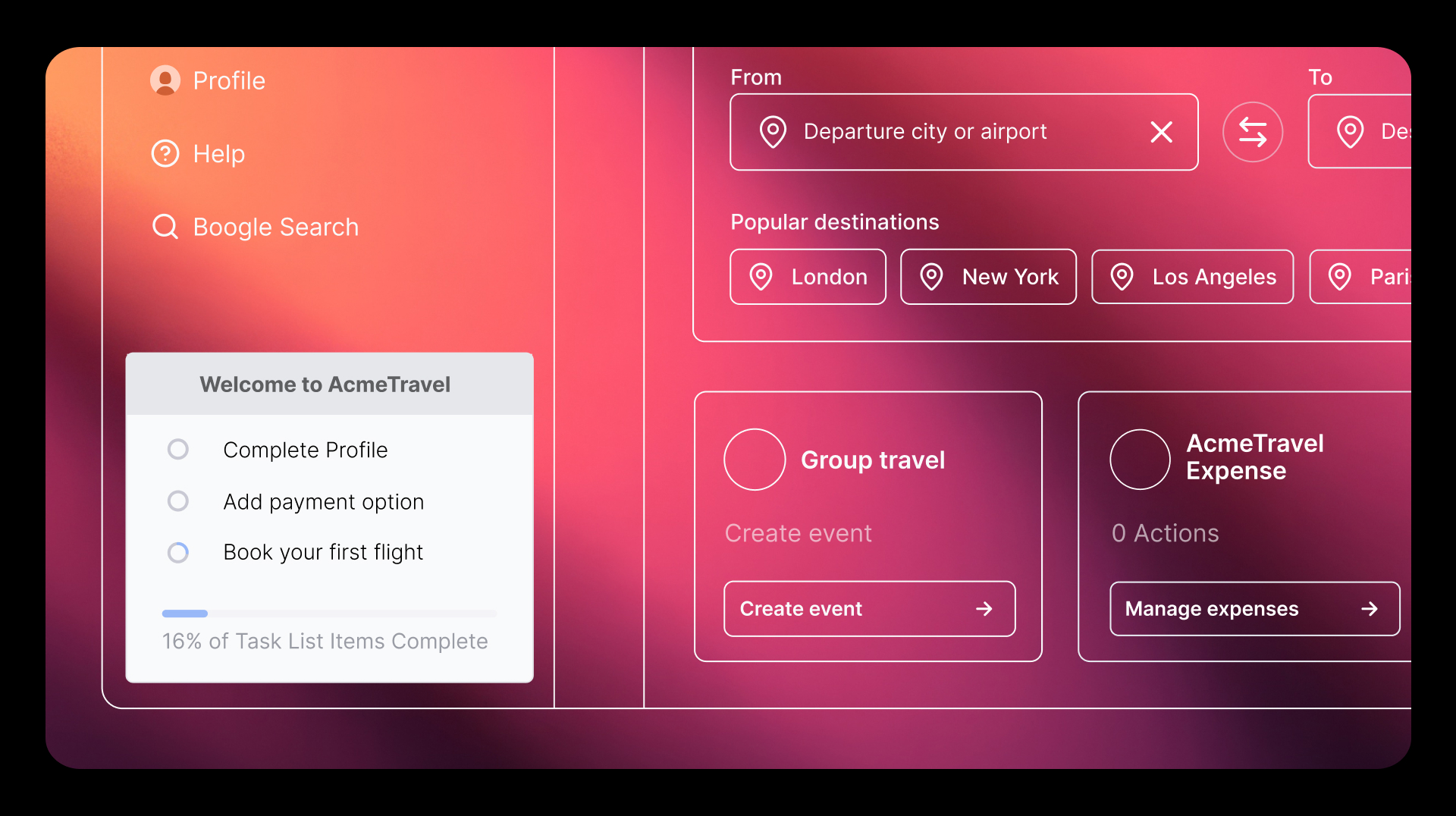

In-app feedback

One of the most effective ways to collect customer feedback is through a widget inside your product. This way, you can track feedback constantly (and on an ongoing basis) and meet customers where they already are. Additionally, asking for feedback while people are using your app will likely generate more valuable responses, since their experience and feelings are top of mind and they can submit feedback when it’s convenient to do so.

Product usage

In addition to tracking what customers say and how they feel, teams need to capture how they behave, too. Product usage data lets you see how customers navigate your app (including which features they access the most), where they get stuck, or when there is drop-off in a certain workflow. This is particularly powerful when combined with other forms of feedback, for example, if you examine product usage and segment by NPS.

Support ticket data

You might not initially think of support tickets as sources of feedback, but they can provide a lot of valuable information. By tracking any common issues that arise, you’ll be able to better understand which areas of the product cause the most problems for customers, and take action quickly. You might also find that these issues align with feature requests you receive from your other feedback sources, which signals that something is worth looking into in more detail.

Social media

What your users say about your product (and company) on social media platforms can be extremely useful, especially when social media posts spark conversations with multiple users. The nature of your business will determine how important social media is to your overall feedback strategy, but there are plenty of solutions available to help you connect this data with the rest of your feedback inputs.

It’s all about balance

In the end, feedback is a two-way street: Sometimes you’ll directly ask for feedback from your customers, and sometimes customers will proactively share their thoughts and requests. Both active and passive feedback are valuable, and it’s important to balance both types in order to get a complete picture of the customer experience–and how you can improve it.

Also keep in mind that not all feedback is created equal. Just because you’re collecting a lot of customer feedback doesn’t mean you should deliver on every single request. By combining multiple types of feedback (and ideally, housing it in a tool that helps you prioritize and understand how significant each piece of feedback is) you’ll be able to get a better sense of what your customers truly want.