Table of Contents

What is customer churn?

Customer churn is a vital metric for any subscription business, especially SaaS companies. It’s a measure of how many customers (sometimes referred to in sales shorthand as “logos”) do not renew at the end of their subscription. Churn can occur prior to the expiration of the subscription term, but this type of turnover is less frequent because it typically requires breaking terms of a contract. Customer churn can also be thought of as the inverse of customer retention.

Are there different types of churn?

There are two types of churn: revenue churn and customer churn.

Revenue churn

Revenue churn measures the financial impact of lost customer contracts, and is usually expressed in dollar value of contracts not renewed.

There are several types of revenue churn:

- Gross revenue churn: Total revenue lost from existing customers, without considering any new revenue from upselling or cross-selling.

- Net revenue churn: Revenue lost after accounting for new revenue from existing customers through upselling or cross-selling. Net revenue churn offers a more balanced view of churn by factoring in revenue recovery efforts.

- Cohort-based revenue churn: Revenue churn within specific customer segments, like company size or industry, to identify and understand trends.

Customer churn

Customer churn is commonly expressed as the percentage of customers who don’t renew their contracts. This type of churn focuses on the number of customers lost rather than the revenue impact. Types of customer churn include:

- Gross customer churn: The total percentage of customers lost in a specific period.

- Net customer churn: The percentage of customers lost after accounting for new customer acquisitions in the same period.

- Cohort-based customer churn: Churn within specific customer segments, like enterprise accounts, to understand which segments are most at risk.

Why does churn matter?

Churn (in all its forms) is such a critical health metric for SaaS businesses because customer acquisition costs are typically high for subscription software companies. So high, in fact, that it’s not uncommon for a vendor to not recoup its acquisition costs until several years into the contract. As a result, early churn means the company lost money on that customer. Similarly, understanding churn is a prerequisite to understanding customer lifetime value, which is another foundational metric for SaaS businesses.

To help identify potential churn before it happens, many companies are turning to product analytics. Restaurant365, a restaurant management software, measures usage across its platform and if an account goes dark or exhibits abnormally low usage, customer success reaches out to find out why and proactively intervene.

Nuanced views of churn

Beyond these basic distinctions, churn can also be viewed through more nuanced lenses:

Preventable churn: Customers who leave due to dissatisfaction, poor customer experience, or lack of engagement. Preventable churn can often be mitigated through targeted retention efforts at unhappy or inactive users:

- Unhappy customers: Customers who churn due to unresolved issues or dissatisfaction with the product or service.

- Inactive users: Customers who stop using the product or service and eventually churn due to a lack of perceived value.

Structural churn: Customers who churn due to reasons beyond the company’s control, such as going out of business or being acquired by another company.

- Out of business: Customers who cease operations and, therefore, cannot continue their contract.

- Acquired customers: Customers who are acquired by another company and no longer need the product or service.

By recognizing the specific reasons behind churn, companies can implement targeted measures to reduce preventable churn and better understand structural churn’s inevitable impact.

How do I calculate customer churn?

Calculating customer churn rate is more complicated than meets the eye: Should it include free trial users? Month-to-month contracts? Should it isolate only customers up for renewal? As a result, SaaS companies vary greatly in the way they answer a question as seemingly direct as, “How many of your customers didn’t renew in a given period of time?”

Because there are dozens of competing formulas for calculating churn, what matters more than the formula(s) a company chooses is that it benchmarks itself consistently. Churn is a moving-target KPI. It can be affected by seasonality, product changes, competitive factors, pricing expectations, customer support, and even PR events. Changing one’s churn calculation regularly will impede the ability to understand what’s causing a company to lose customers and make changes to its business, which, in the end, is why one tracks the metric in the first place.

What drives customer churn?

Not all customer churn is preventable. If a company goes out of business or gets acquired, there’s little chance of saving that customer. This is often referred to as “structural churn.” The opposite of structural churn is preventable churn, and in these cases, companies and decision-makers tend to look at a few consistent criteria when deciding whether or not to renew a product or service. Questions they’re likely to ask themselves include:

- Value: What benefits do I get when I use this product? Do I get what I expected when I initially bought?

- Usage: How often do I use this product? Is this a mission-critical, daily use application, or is this an infrequent, nice-to-have?

- Relationships: How attached am I to the people behind the product? Is there a strong bond between a customer success team and an internal champion? Do I feel invested in this specific company’s product?

- Alternatives: Are there other ways to solve my problem? Would I use them more frequently, or do I have a stronger relationship with an alternative provider?

How to predict customer churn

Predicting customer churn requires two things:

- Understanding of your customers’ interactions with your brand. You can do this with a session replay tool!

- Key operational metrics like product usage data. Pendo product analytics software is perfect for this!

By unifying your data, businesses can identify early indicators of churn and develop proactive strategies to retain customers. A less manual way would be to use something like Pendo Predict which is a AI churn prediction software.

What is churn prediction software?

Churn prediction software uses AI and machine learning to analyze customer behavior, product usage, and engagement data to identify which customers are at risk of churning. Unlike manual health scores, modern customer churn prediction software does not take signifcant time and resources to set up and continuously learns from patterns across thousands of data points to deliver accurate, actionable predictions.

The best churn prediction tools provide:

AI-powered predictive models that analyze product usage, engagement patterns, and customer attributes in real-time—identifying at-risk customers 3-6 months before renewal.

Explainable predictions that show not just who will churn, but why—pointing to specific usage patterns, feature gaps, or engagement drops that indicate risk.

Integrated workflows that deliver insights directly into existing tools like Salesforce, HubSpot, and in-app guides so teams can act immediately.

Continuous learning through models that automatically retrain themselves as customer behavior changes, improving accuracy without manual maintenance.

Pendo Predict is an AI-powered churn prediction platform that builds predictive models from your product and CRM data—all without requiring a data science team. It identifies both churn risk and upsell opportunities, delivering insights directly into your team's workflows.

Traditional vs. AI churn prediction methods

Traditional approaches rely on manual scoring systems using basic metrics like login frequency or support tickets. These rule-based health scores (red/yellow/green) require constant updates and miss nuanced patterns.

AI churn prediction software analyzes hundreds of data points simultaneously—product usage, feature adoption, engagement trends, CRM signals, and support interactions. These predictive AI models continuously retrain and improve accuracy over time without manual intervention.

The key advantage: AI identifies subtle behavioral patterns humans would never spot, providing probability scores (e.g., "78% likely to churn") with specific reasons for each customer's risk level instantly.

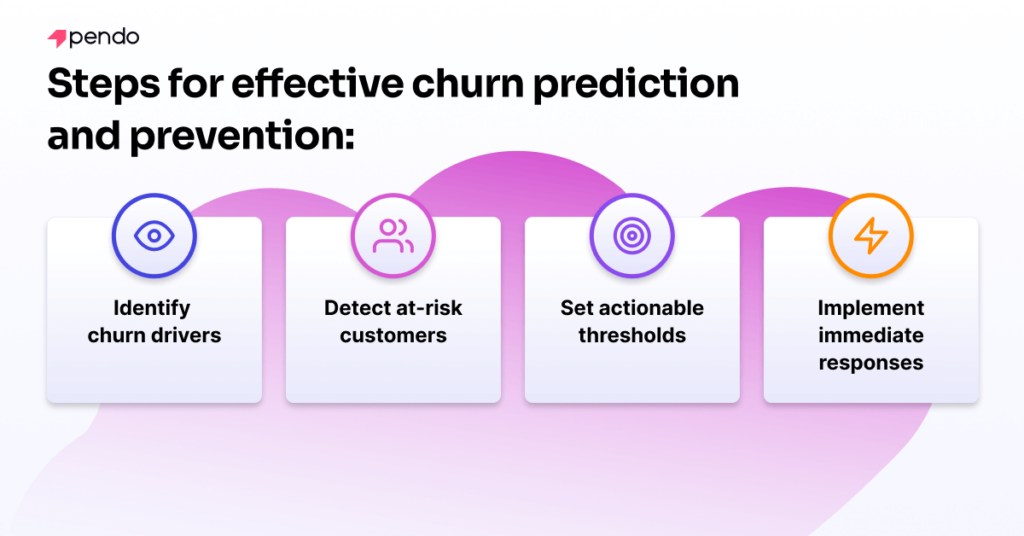

Here are four essential steps to predict and prevent churn:

- Identify churn drivers: Analyze qualitative, quantitative, and visual data to understand the specific behaviors and factors that lead to customer departure.

- Detect at-risk customers: Utilize predictive analytics to recognize patterns and signals that indicate a customer might be considering leaving.

- Set actionable thresholds: Determine specific criteria for when to initiate retention efforts, based on the calculated risk of churn.

- Implement immediate responses: Develop a system for quickly addressing the needs of at-risk customers through personalized follow-ups and interventions.

Use product data to detect and prevent churn

To accurately predict churn, creating a predictive model is crucial. This involves integrating product data (like user stickiness and feature adoption) with experiential data (like Net Promoter Scores and user feedback). By analyzing these combined datasets, the model can assess the likelihood of churn for each customer, allowing businesses to act preemptively.

Product experience platforms like Pendo make understanding your customer health dramatically easier. For a proactive approach, explore Pendo Predict, an AI-powered churn prediction tool that identifies at-risk users before they churn. Usage data, feedback, session replays, and more help you understand and segment users to pinpoint at-risk customers and craft personalized retention strategies.

With your product’s insights, companies can foresee potential churn and implement timely, targeted measures to improve customer loyalty and retention.

Predicting your revenue engine with product engagement scores (PES)

Pendo’s data science team wanted to see if we could predict whether a customer would churn, renew flat, or grow its contract with only PES. We found that PES is strongly correlated with customer retention: Months before contract renewal, accounts with the highest PES were most likely to renew and expand, while accounts with the lowest PES were most likely to churn.

How to reduce customer churn and retain existing customers

Reducing customer churn involves not just rescuing at-risk customers but proactively creating a positive experience throughout their journey. Here are key strategies to help reduce churn and keep your customers engaged:

Enhance your product and customer experiences

- Make the sign-up and onboarding process as seamless and welcoming as possible with in-app guides and automated, personalized onboarding for different roles.

- Ensure your customer support is quick and effective, and provide easy access to assistance and feedback.

- Give users personalized experiences by tailoring in-app communications to individual needs, jobs to be done, and preferences.

Educate and empower customers

- Provide educational content like in-app tooltips, walkthroughs, demos, how-to guides, and FAQs via your in-app resource center.

- Offer accessible support through live chat or chatbots, and give users in-app methods to share feedback.

- Engage with users on social media and other channels to respond to customer queries and address concerns in real-time.

Reward loyalty to incentivize repeat business

- Implement loyalty programs that reward customers with points for purchases and interactions, which can be redeemed for rewards.

- Offer exclusive discounts and special deals for repeat customers to encourage them to return.

- Create VIP programs that provide additional perks for your most loyal customers, making them feel valued and appreciated.

Show appreciation for your high-value customers

- Send personalized thank-you notes and offers to show your gratitude towards high-value customers.

- Invite enterprise accounts to exclusive events and webinars to make them feel special and involved.

- Provide tailored offers based on their preferences and behaviors, ensuring they receive the best possible experience with your brand.

Listen and act on implicit and explicit feedback

- Collect detailed feedback within your app (and outside of it) through surveys and forms to gain insights into customer experiences.

- Analyze user behavior data, such as product engagement scores (PES), to identify patterns that indicate potential churn.

- Use sentiment analysis tools to gauge customer feedback and respond promptly, addressing any issues before they lead to customer attrition.

How Pendo helps predict and prevent customer churn

Pendo Predict: AI-powered churn prediction software

Pendo Predict specifically adds AI-powered prediction to identify which specific customers will churn and why—before it happens.

Generates predictions in days, not months: No data science team required. Automatically builds and trains predictive AI models from your product and CRM data.

Explains why each customer is at risk: Surfaces specific reasons like declining feature usage or reduced login frequency so teams know how to intervene.

Identifies upsell opportunities: Predicts both churn risk and expansion potential to focus efforts on retention and growth.

Delivers predictions into workflows: Integrates with Salesforce, Slack, email, and Pendo Guides for immediate action.

In addition to Predict, the rest of Pendo's comprehensive product experience platform gives teams even greater visibility into customer health:

- Product analytics: Track usage patterns that indicate churn risk like declining sessions or abandoned features

- In-app guides: Proactively educate at-risk users with walkthroughs to drive feature adoption

- Session replays: Identify friction points causing frustration before they drive cancellations

- Feedback collection: Capture sentiment through NPS and surveys to understand the "why" behind churn risk

By combining Pendo's behavioral analytics with Pendo Predict's AI churn prediction models, teams get both the "who" and the "why"—plus the tools to intervene effectively.

Explore Pendo Predict today!

What is a good customer churn rate?

For B2B SaaS companies, an annual churn rate of 5-7% or lower is considered healthy. Monthly churn benchmarks vary by segment:

- Enterprise B2B: Good is 1-2% monthly, great is under 0.5%

- SMB/Mid-Market B2B: Good is 2.5-5% monthly, great is under 1.5%

- B2C subscription: Good is 3-5% monthly, great is under 2%

The best measure is a rate that's trending downward and allows sustainable growth. Use churn prediction software to continuously improve retention metrics.

How can AI predict customer churn?

AI churn prediction uses machine learning to analyze patterns across product usage, engagement data, and customer attributes. These models identify subtle behavioral signals that precede churn—like declining feature adoption or changing login patterns—often 3-6 months before renewal.

Unlike rule-based systems, AI models automatically discover which combinations of signals are most predictive and continuously improve accuracy over time without manual intervention.

What's the difference between churn prediction software and health scores?

Traditional health scores use simple rules based on a few metrics (red/yellow/green). Churn prediction software uses AI to analyze hundreds of signals simultaneously, providing probability-based predictions (e.g., "78% likely to churn within 90 days") with explanations of which specific behaviors drive each customer's risk score.

AI-powered churn prediction is more accurate, requires no manual updates, and integrates predictions directly into workflows with recommended actions.

How to build a customer churn model?

Building a churn prediction model traditionally requires: data collection, cleaning and feature engineering (60-80% of work), model selection, training, validation, deployment, and continuous monitoring. This typically takes 6-9+ months and requires data science expertise.

Modern churn prediction software like Pendo Predict eliminates this complexity—automatically building production-ready predictive AI models in days rather than months, with zero data science resources required.

Can customer churn be negative?

Yes! Negative churn occurs when expansion revenue from existing customers exceeds revenue lost from churned customers. If you lose $10,000 in MRR from churned customers but gain $15,000 from upsells and expansions, you have negative churn of -5%.

Achieve this by focusing on land-and-expand models, using upsell prediction software to identify expansion-ready accounts, and implementing usage-based pricing that grows with customer success. Pendo Predict identifies both churn risk and upsell opportunities to help reach negative churn.