Table of Contents

In a rush?

Download the PDF for later

As banking continues its move from a branch- based, in-person errand to a digital experience, financial institutions need to make it easier for customers to manage their finances with a few taps on a smartphone, and for employees to understand and navigate the platforms that enable those actions.

Pendo provides the insights that help banks and financial institutions understand how customers and employees are using your products, and enables you to guide, educate, and communicate with users inside those applications. This is all with the goal of ensuring customers have a seamless and safe experience managing their money and finances.

Onboarding

A good product experience begins with a successful onboarding process. Pendo in-app guidance can help a new banking customer navigate through an app on their first login and set them up for success by helping them complete milestones like ordering checks, making a deposit, and paying a bill. It can also help a long-time customer get the most out of your more complex banking features, like analyzing credit scores, applying for loans, or setting up or modifying a series of payments or transfers.

Banking is a complex and highly-regulated industry. Building out effective onboarding processes for new branch managers or agents can help arm them with the information they need to handle sensitive transactions or customer questions.

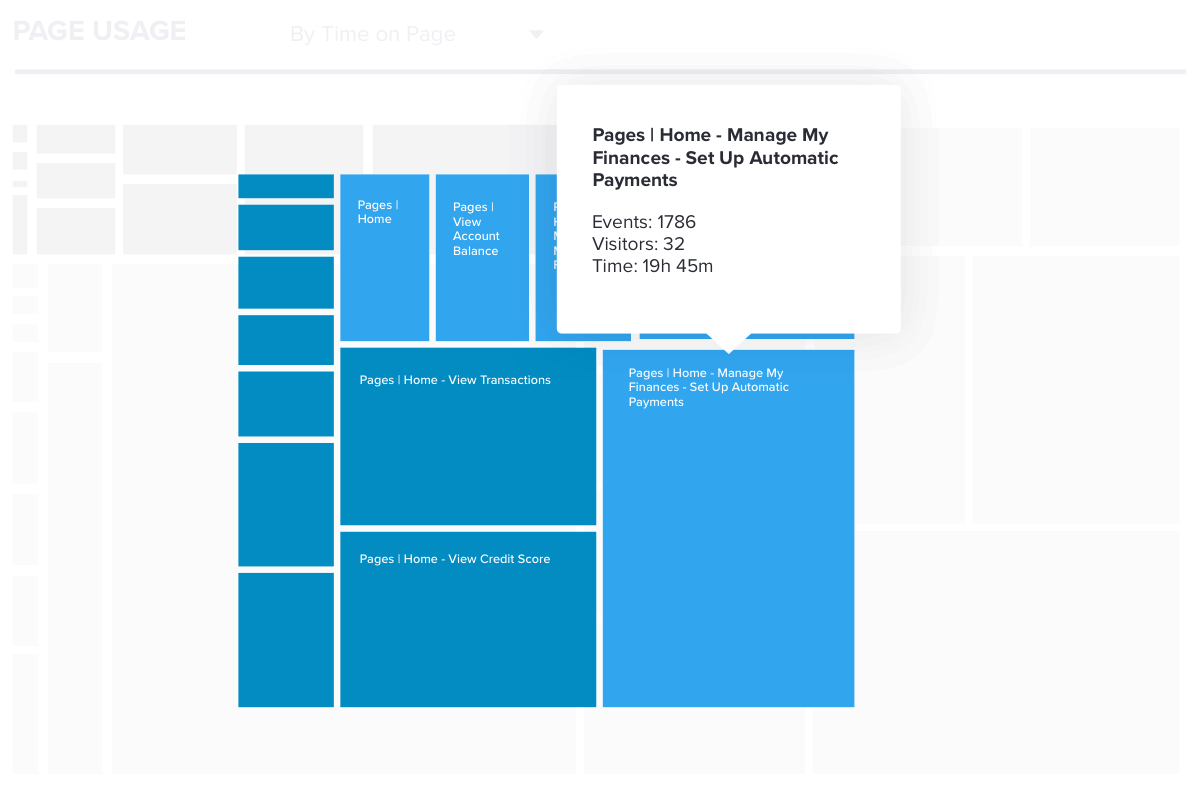

Pendo’s easy-to-use interface for designing guides lets you modify content in real time. You can use Pendo’s analytics capabilities to reveal the paths taken by the most successful power users on your app, then design your onboarding and guide flows around their experience to help less successful users follow in their footsteps.

Or, if you notice some users aren’t completing your onboarding flows, Pendo paths and funnels can be used to find the spots where they’re falling out and modify or add guides to help them get to the next step. This can lead to higher app retention.

Please fill out the form below to read the rest of this e-book.

Education and training

Pendo’s Resource Center helps keep contextual in-app guidance front and center and easily accessible to your users from wherever they’re working in your app at the moment. You can use them to communicate important information—as many Pendo customers did during COVID-19— or draw attention to new features to drive up adoption.

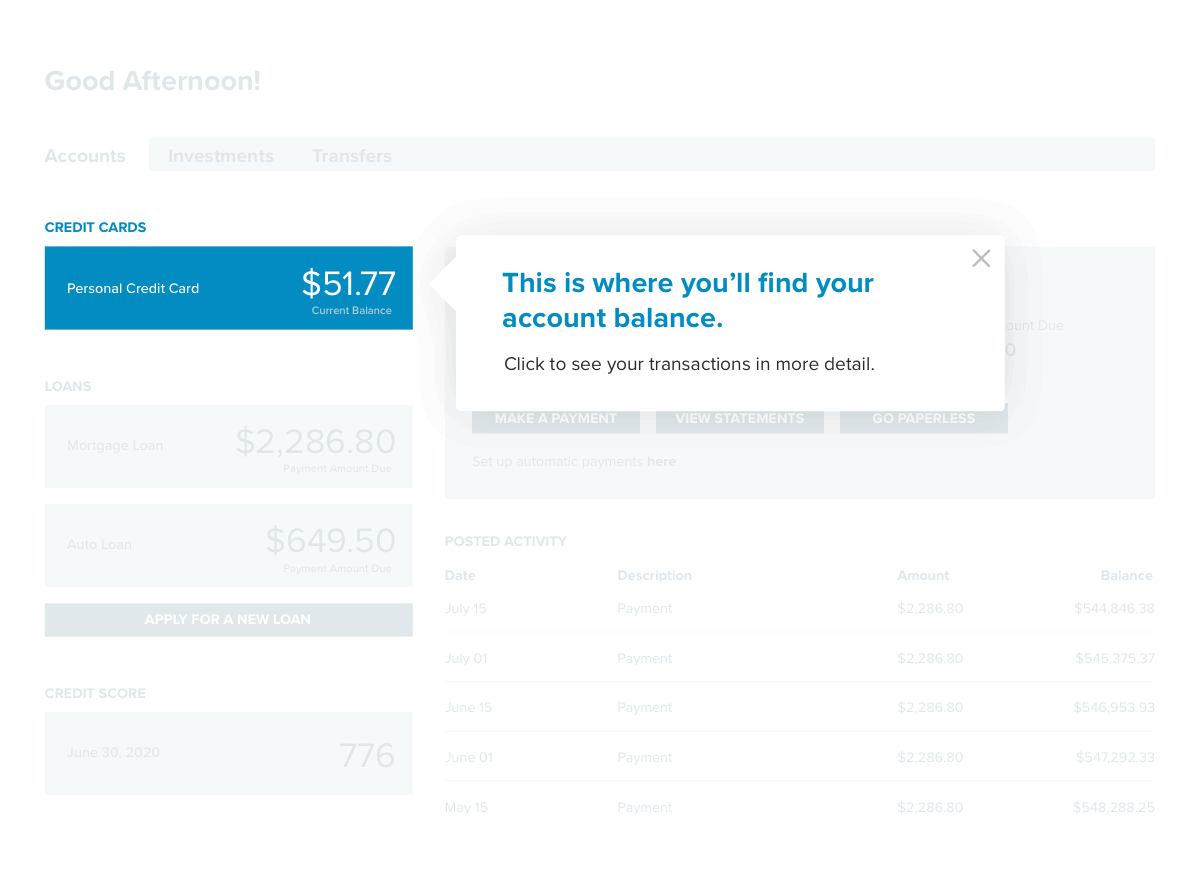

Say you’re fielding a lot of calls to your customer support center from customers who are confused by the difference between the available balance in their account and the current balance. Just whip up a tooltip guide and drop it right on the page where those terms appear to clear the confusion up proactively.

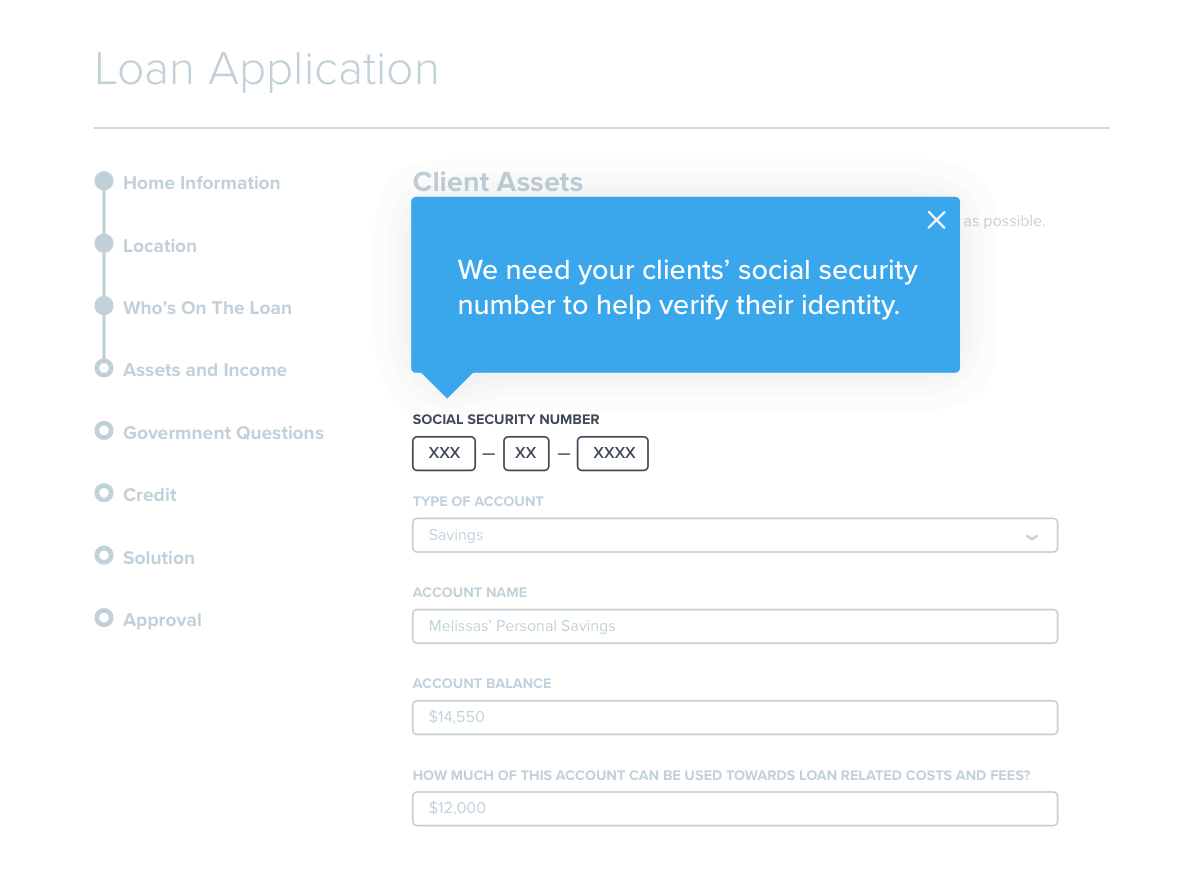

Pendo’s guidance features also make it easy to offer in-app training for branch employees, or on- the-fly instruction. A well-placed guide in an agent-facing product can take the frustration out of explaining a complicated loan application to a customer.

Real-time user communication

Since there’s little to no need to involve scarce engineering resources when analyzing usage data or building guides in Pendo, the software can also help reduce your technical debt and speed up deployment of in-app messaging. That gives users the ability to respond in near real-time when necessary. It’s a position many Pendo customers found themselves in during the early days of the coronavirus outbreak.

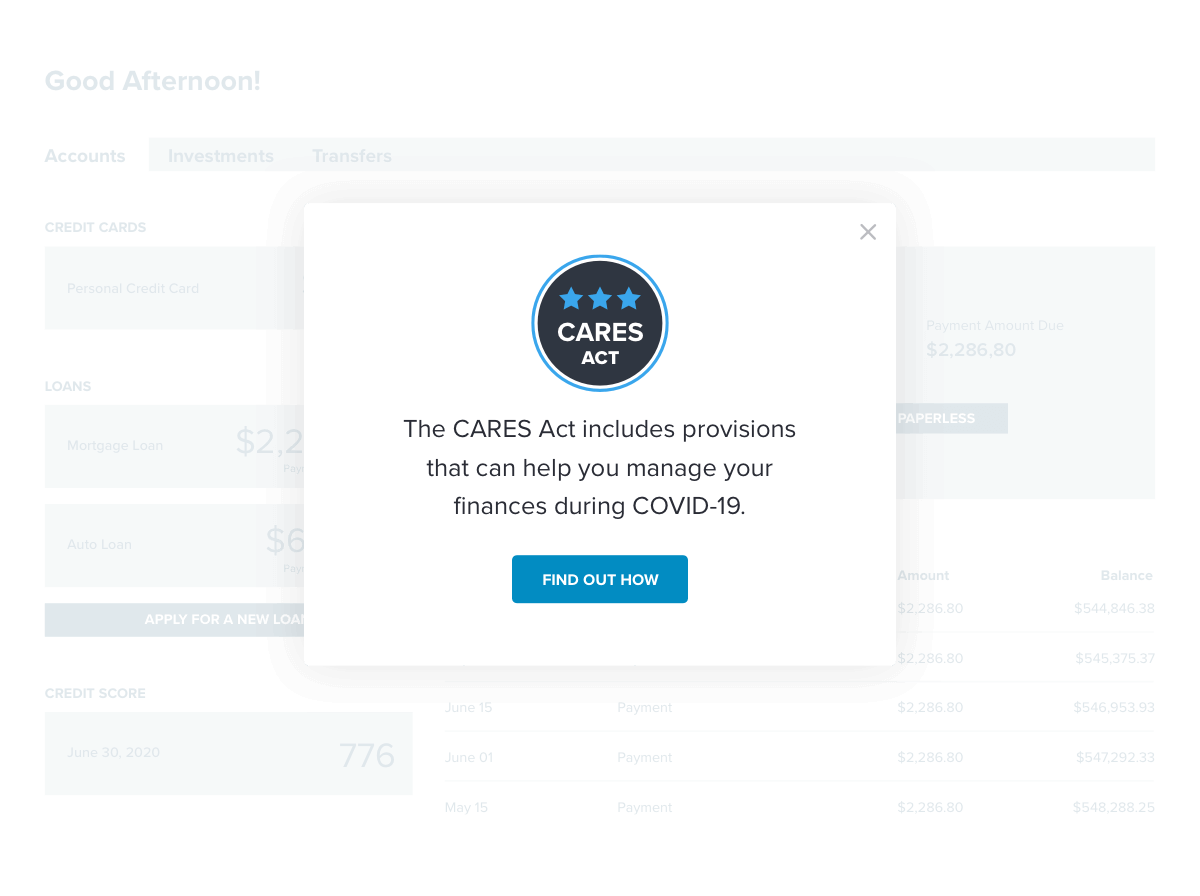

One large financial services company used Pendo guides to make users aware of provisions in the federal CARES Act, passed in response to COVID-19, that allows people to suspend payments on their outstanding 401k loans. Then, more guides were used to show them how to take advantage of the regulations and to automatically enroll those who qualified for the program and had opted in.

Measure sentiment, drive retention and loyalty

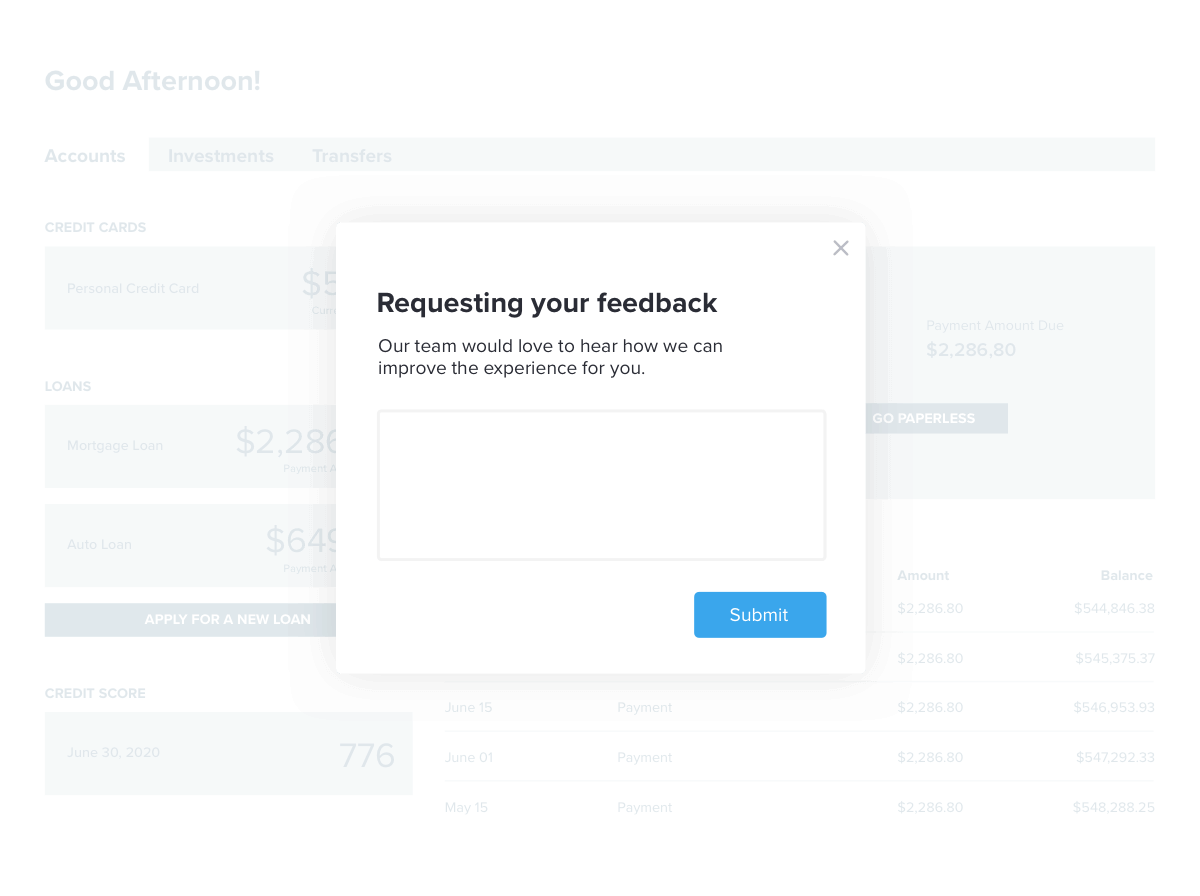

Staying close to your customers, keeping them engaged, and helping them find value in your platform is a sure-fire way to boost your retention rate. Pendo’s ability to gauge user sentiment through NPS collection makes it easy to keep a finger on the pulse of your user base. If customers seem to be having an issue navigating to a page that lets them transfer funds between accounts, for instance, you could pop a guide to collect NPS and qualitative feedback from them to find out how to make that feature more discoverable. Then, you can gauge whether your fix worked by following up with another survey.

Pendo can put that NPS data at the fingertips of your entire organization, automatically feeding the results into a dedicated place, like a Slack channel or a spreadsheet, so you can get it in front of the people most equipped to handle the issues reported by detractors, or reach out directly to promoters with in-app messaging or surveys for research purposes or to ask them to submit online reviews.

Grow revenue

Using Pendo to keep a close eye on which customers are using your app the heaviest and those who aren’t logging very often at all can open up opportunities to upsell new financial offerings or catch churn risks and re-engage them with in-app messages or via email before they leave your platform.

Pendo Feedback

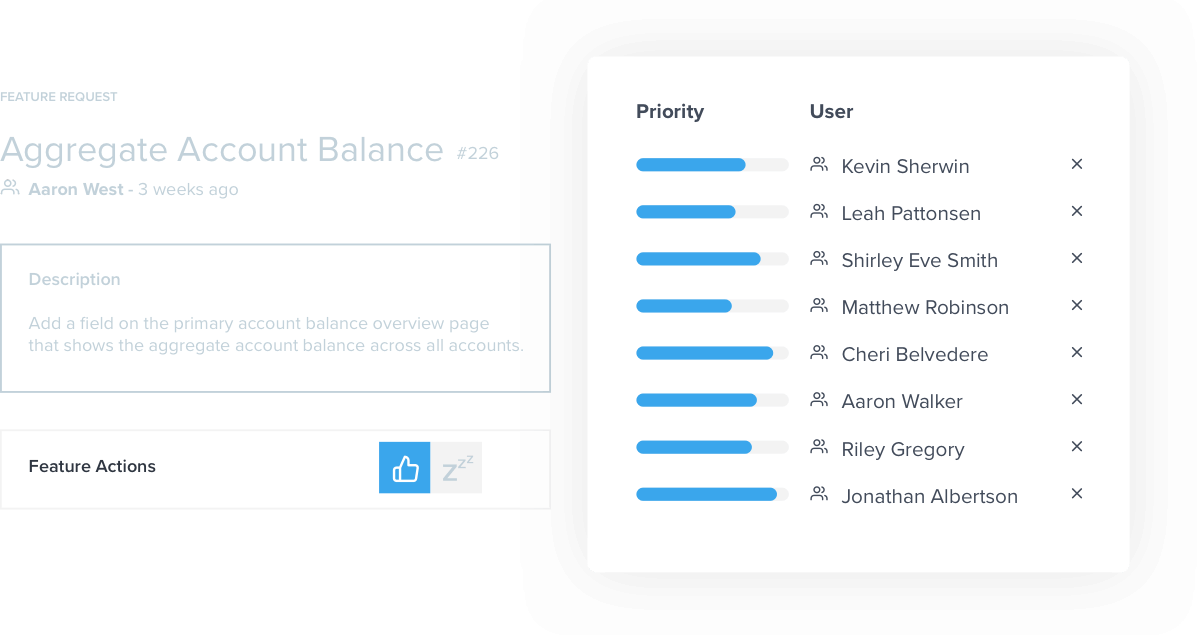

Pendo Feedback makes it simple and efficient to collect, organize, prioritize and make product decisions from user feedback. Users can submit feature requests and vote on those submitted by others. That way, you can single out the most requested and highest value projects that require the lowest effort to prioritize on your roadmap.

Then, make that roadmap public, so that all the users who submitted feature requests aren’t left wondering if they were received or if they’re being worked on.

One of Pendo’s customers, a large wealth management platform, completely replaced their antiquated system of collecting user feedback on a spreadsheet and manually sifting through it with Feedback.