The difference between measuring success for customer-facing and employee-facing products

One of the biggest challenges for product leaders is ensuring they’re able to accurately track progress toward their organization’s goals. After all, as the adage goes, you can’t improve what you don’t measure.

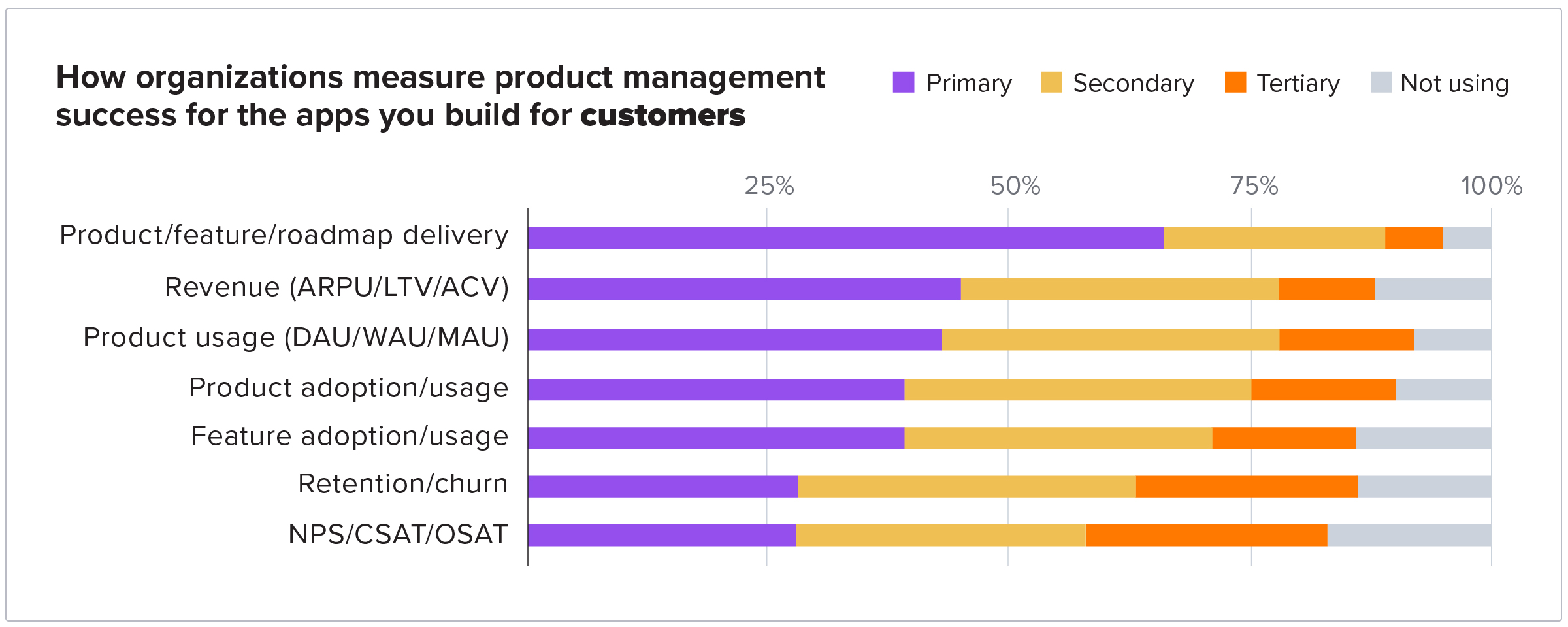

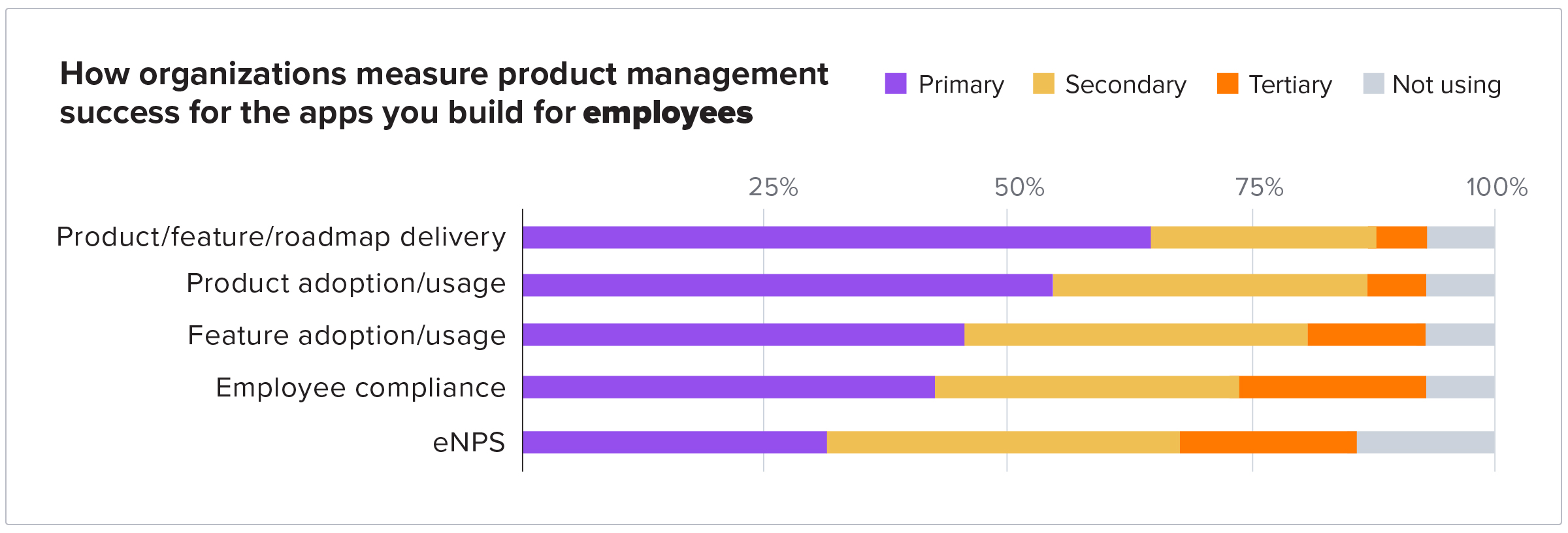

But what success looks like differs quite a bit for product teams working on apps that they’ll sell to customers versus those they’re building for internal use by their organization’s employees. We explored this idea in the 2021 State of Product Leadership report, asking product leaders how they measure product management success for apps built for customers and those built for employees.

Here are the metrics each group prioritizes, according to this year’s data:

When we take a closer look, a lot can be learned from these two graphs—let’s dig in.

The metric(s) unique to each group

Let’s first unpack the biggest difference between the two: Each has at least one unique metric that the other doesn’t. For customer-facing apps, that’s revenue and retention. For employee-facing apps, it’s compliance.

That PMs on employee-facing apps aren’t directly concerned with revenue isn’t much of a surprise. After all, they aren’t planning on selling these apps to anyone, at least not in the sense of driving immediate revenue.

App retention and churn aren’t top concerns either, because employees don’t have a choice in whether they use these apps—they’re internally-developed and mission-critical. That’s where the adoption and compliance metrics come into play: These PMs are tasked more with ensuring the app is adopted throughout the organization and used in a uniform fashion rather than preventing employees from switching to competing software.

It should be noted, however, that these PMs are responsible for ensuring retention in another sense: Employees that are forced to use software that offers a subpar or even frustrating user experience are more likely to be less happy at work, increasing the risk that they’ll either suffer from lower productivity, or look for employment elsewhere. Neither of those outcomes bode well for your organization’s revenue goals.

Curiously, both sets of product leaders said satisfaction and sentiment metrics like NPS, eNPS, CSAT, and OSAT—indicators of exactly that outcome—were least important in their eyes.

Where there’s overlap

Now, the similarities. Whether a product leader is working on an internal or external app, delivering on the promises they’ve made around features and the product roadmap take the top spot, followed by usage metrics.

This suggests that product leaders are most concerned with building and maintaining trust among their customers and ensuring that they find the product useful and valuable, so that they’ll keep using it. This makes sense: The more value users find in an app, the more they’ll use it, and the more likely are they’ll recommend it to their peers and colleagues. Increased revenue is the natural outcome of this progression.

So, success for most product leaders means keeping promises. In short, product leaders want their work to be useful and valued. Monetization comes second to delivering on promises to customers and internal stakeholders.

Want to learn more about the state of product leadership in 2021? Download the full report here.