How Morgan Stanley at Work makes customer priorities their own

Morgan Stanley at Work at a glance

Morgan Stanley at Work provides workplace financial benefits that build financial confidence and foster loyalty—helping companies attract and retain top talent.

Challenge

Facing churn issues, Morgan Stanley at Work needed a proactive approach to addressing client pain points.

Pendo’ing it

Using Pendo Analytics to track client health, Morgan Stanley identifies markers that predict where intervention is necessary.

Results

Through Pendo, Morgan Stanley created a system to identify client issues before they lead to churn and deliver a more proactive and client-centered experience .

Contents

A business can only be as successful as the talent that powers it. That’s the guiding ethos of Morgan Stanley at Work, the division of the storied wealth management firm that provides workplace financial solutions to ~40% of the S&P 500 and their employees across the world.

Whether it’s through industry-leading workplace financial solutions including financial wellness, equity compensation, and retirement, or access to financial planning and risk management software solutions, financial education and thought leadership initiatives, Morgan Stanley at Work is on a mission to help employees everywhere pursue their financial goals. And with the right tech to support them, they’re making sure that their priorities are always aligned with what’s top of mind for their clients.

Investing in customers’ wants and needs

As Mark Mitchell, Morgan Stanley at Work’s chief product officer, explained, the company’s vigorously customer-centric approach to business arose from a challenge: A large and important client’s satisfaction abruptly dropped. “As we pulled the situation apart, it turned out there were a number of things to improve,” Mitchell reflected. “The relationship had gone sour over a number of years. Our people thought everything was fine. This situation was totally our fault—and it was totally avoidable.”

In order to avoid future adverse outcomes, leadership got to thinking: What if there were a way to predict when a client might become at-risk before it happened? How could Morgan Stanley at Work proactively ensure clients were getting the maximum value from their platform and services? The company took a deep dive to understand what the measurable business results were that led to client success, and quickly realized what it was that led the client in question to churn.

To begin with, the client had not taken advantage of any of Morgan Stanley at Work’s automation capabilities, instead building manual processes that were time-intensive and cumbersome. On top of that, the client had not adopted a single new feature in more than two years. This was especially alarming to see, because some of the features in question would have addressed the pain points that caused the client to churn.

The “happiness markers” of a satisfied client

In analyzing these and other findings, Morgan Stanley at Work chose to treat the client churn episode as an opportunity to do better. They took their learnings and created a program which they now run for all clients. The aim of the program is simple: to “replace perception with prediction.” Using Pendo, the company created dashboards to measure what mattered most to clients–what Mitchell referred to as “happiness markers.”

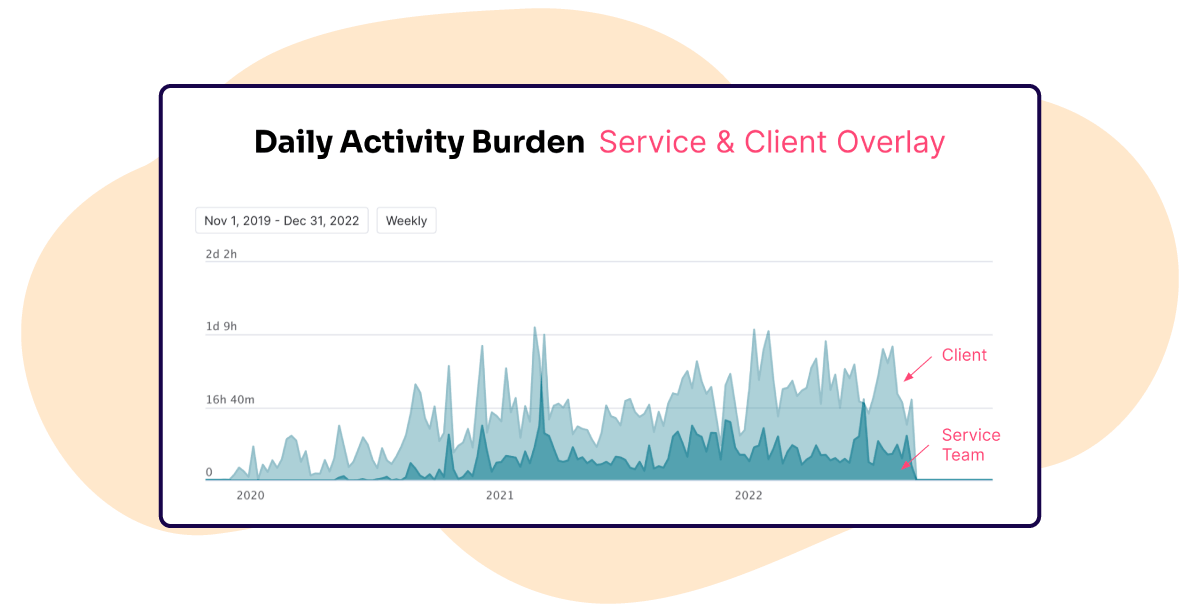

Daily activity burden

One such marker is the daily activity burden. It’s a view of how much time Morgan Stanley customer service teams are spending in the platform compared to their client teams. There’s no perfect ratio, Mitchell explained. More important is to watch for major shifts. “The client’s time in the platform increasing inversely to our team’s time in the platform is a red flag,” he said.

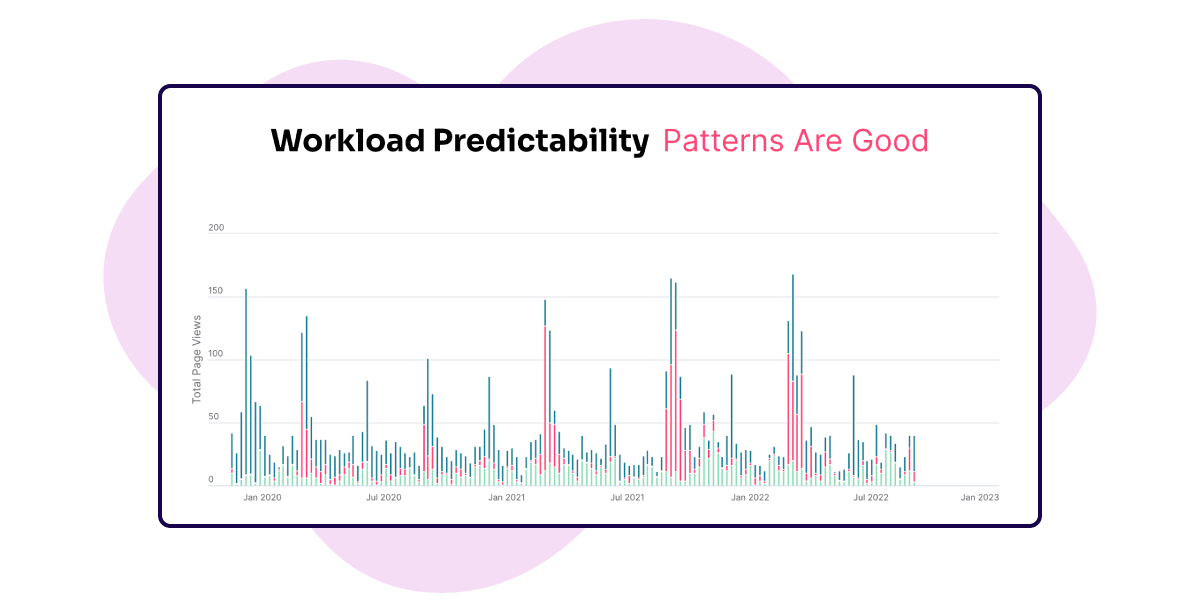

Workload predictability

Another key “happiness marker” Morgan Stanley at Work tracks is Workload Predictability. “We found that our happiest, most satisfied clients use the platform in a way that is very predictable and aligns with key activities,” Mitchell explained. “That’s not to say that clients who use the platform irregularly are necessarily unhappy, but it is true to say that clients who use the platform predictably are happier.”

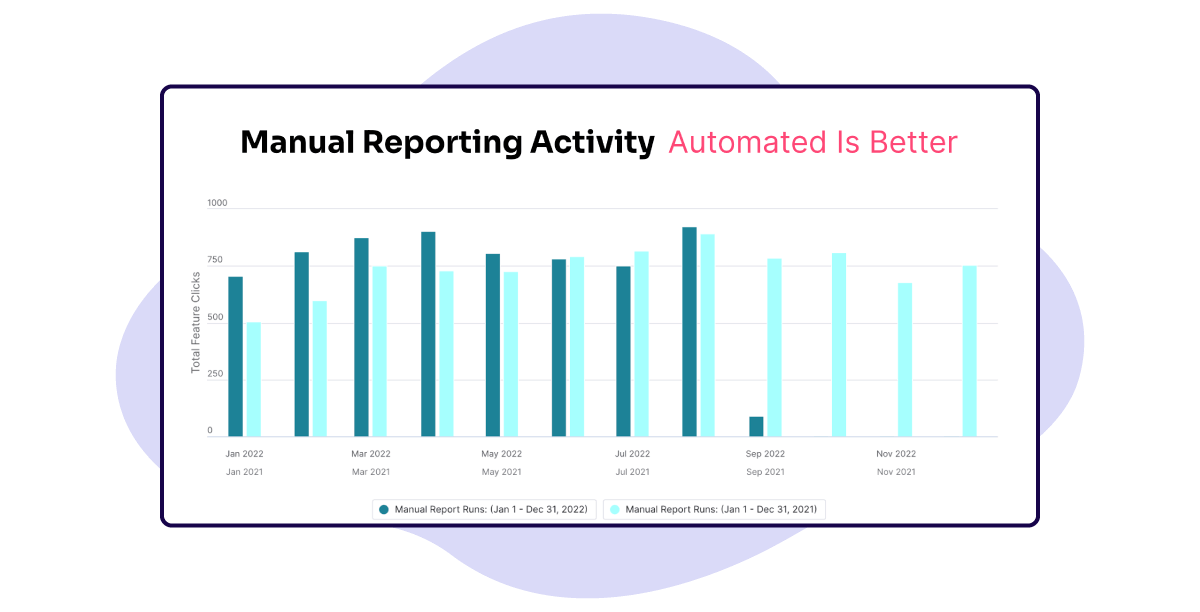

Manual reporting activity

Part of using the platform regularly involves automation. Morgan Stanley at Work’s platform has very powerful reporting capabilities. If set up properly, all reports from the platform can be run on demand or automated and scheduled, and then be sent to people and locations outside the platform. The clients who automate reports are always happier than those who run their reports manually, Mitchell said.

So to that end, Morgan Stanley at Work keeps a close eye on every client’s manual report running activities. Any month-over-month increases in manual report generation are a clear negative indicator of happiness, Mitchell said. It’s a sign for a representative from customer success to intervene and assist the client.

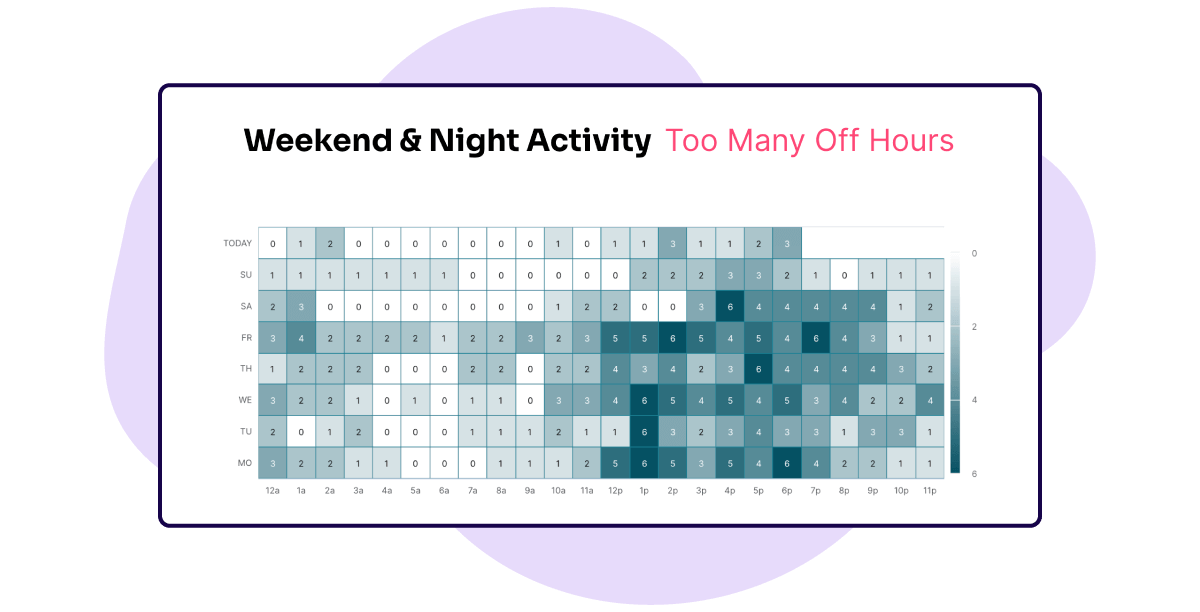

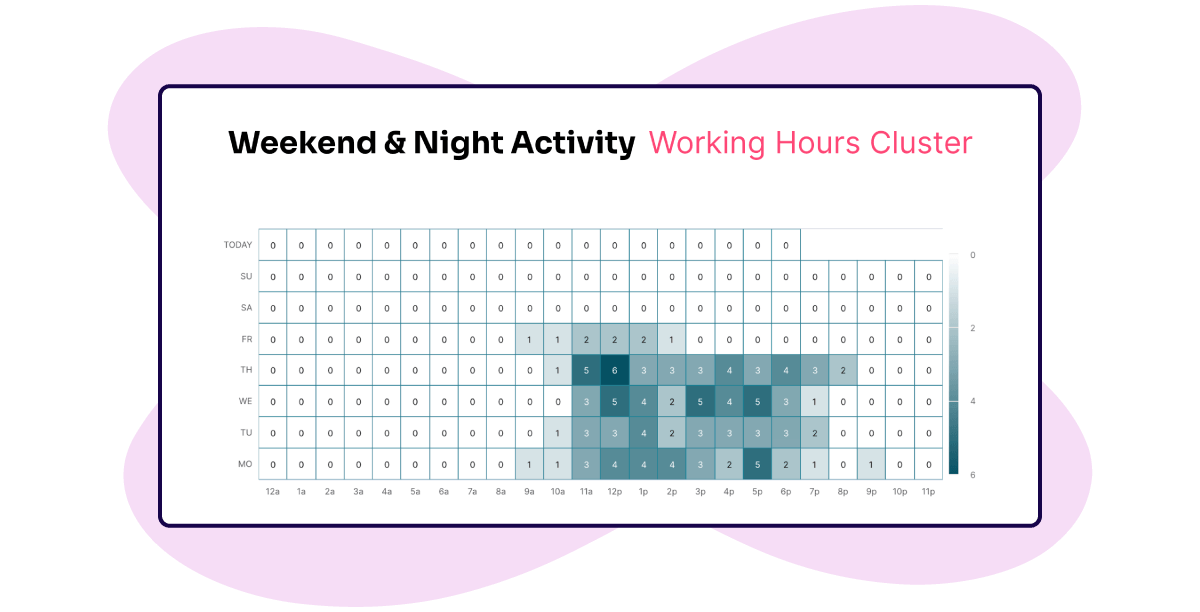

Weekend & night activity

As a final happiness marker, Mitchell noted the importance of tracking client activity during off hours. “Clients who work regular hours and keep their nights and weekends for themselves are definitely happier clients,” he said. “We like to see clients who cluster their work to normal business hours.”

Being data-driven delivers a better customer experience

Morgan Stanley at Work came out of a bad situation and used it to build a stronger business. They took concrete steps to help client companies and their employees prioritize workflow automation, process optimization, and overall better outcomes. And they’ve used Pendo to build a system to proactively monitor client health. Mitchell summed up the key to their success: “We started to understand how to measure what was valuable to the clients and the users—not what was valuable to us.”