Must read

November 20, 2025

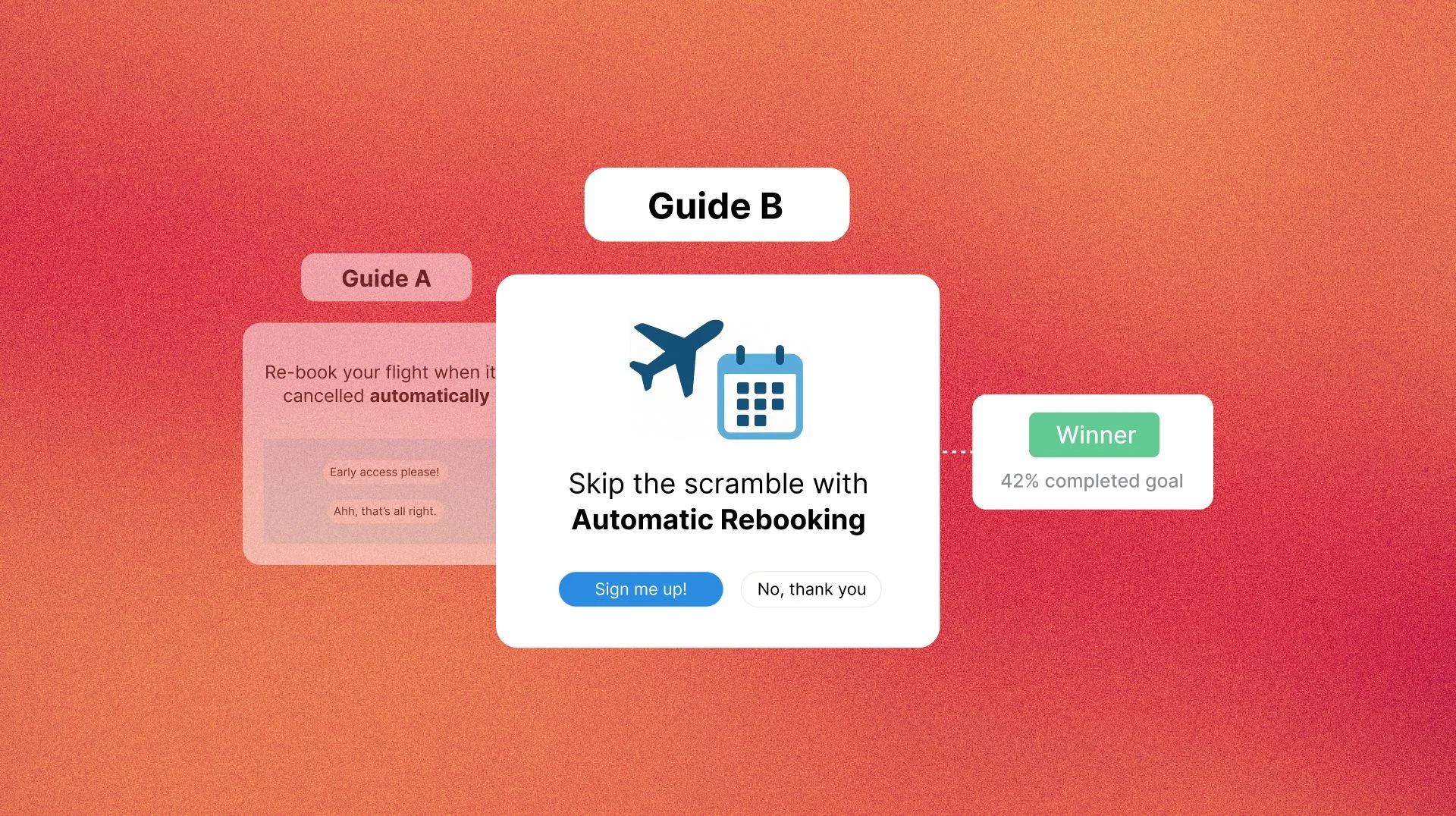

Three things you can start doing today with Pendo Guide experiments

If you've been running in-product guides for a while, you've probably developed some strong opinions about what works.

Read nowLatest

News –– 3m read

Announcing the Pendo MCP Hackathon

Watch now

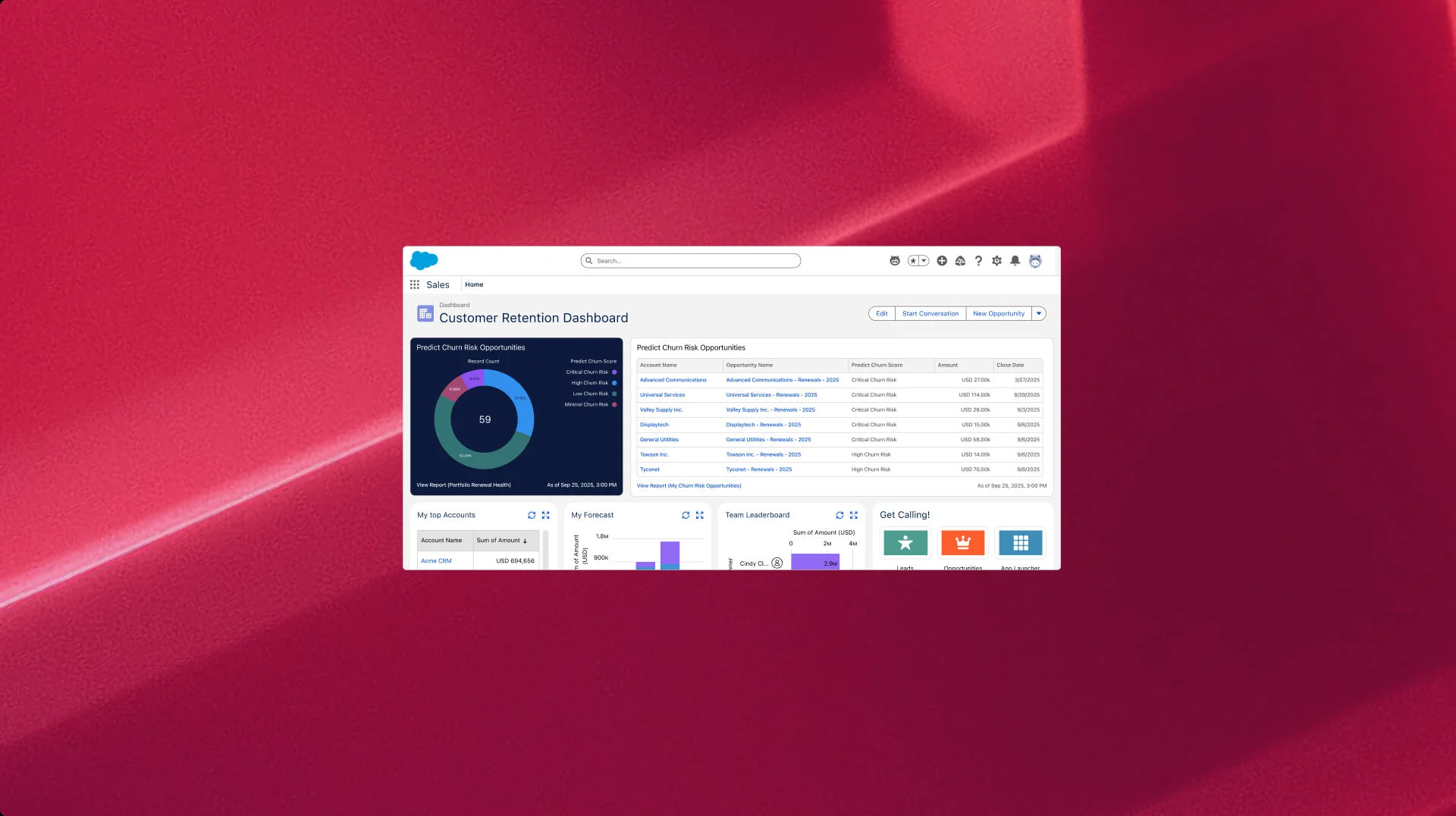

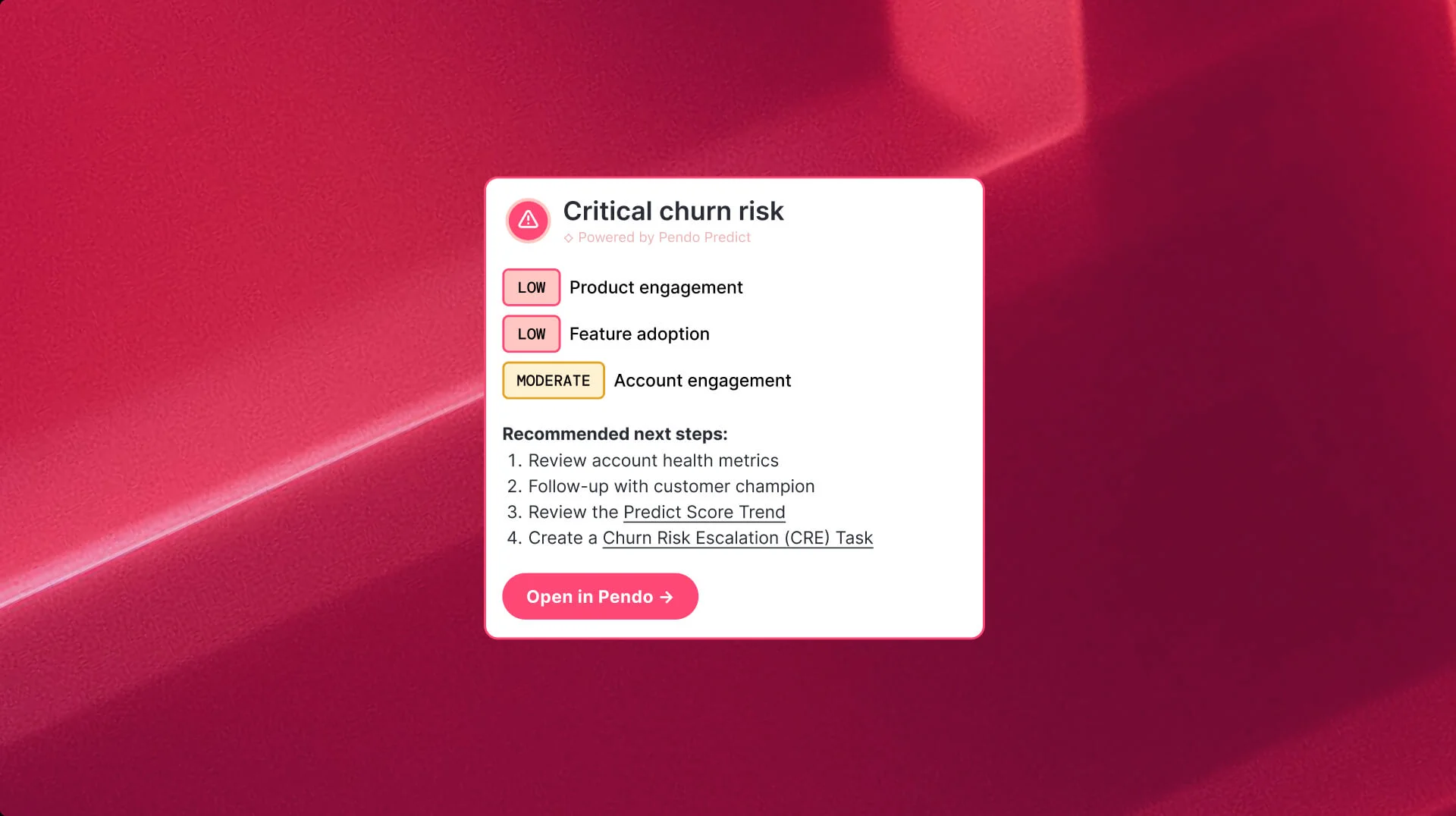

AI-powered churn prediction at scale

Sneha Raghavan, VP of customer success, talks about the power of Pendo Predict and how it uses product signals to directly impact revenue outcomes.

Read about itGet to know Pendo

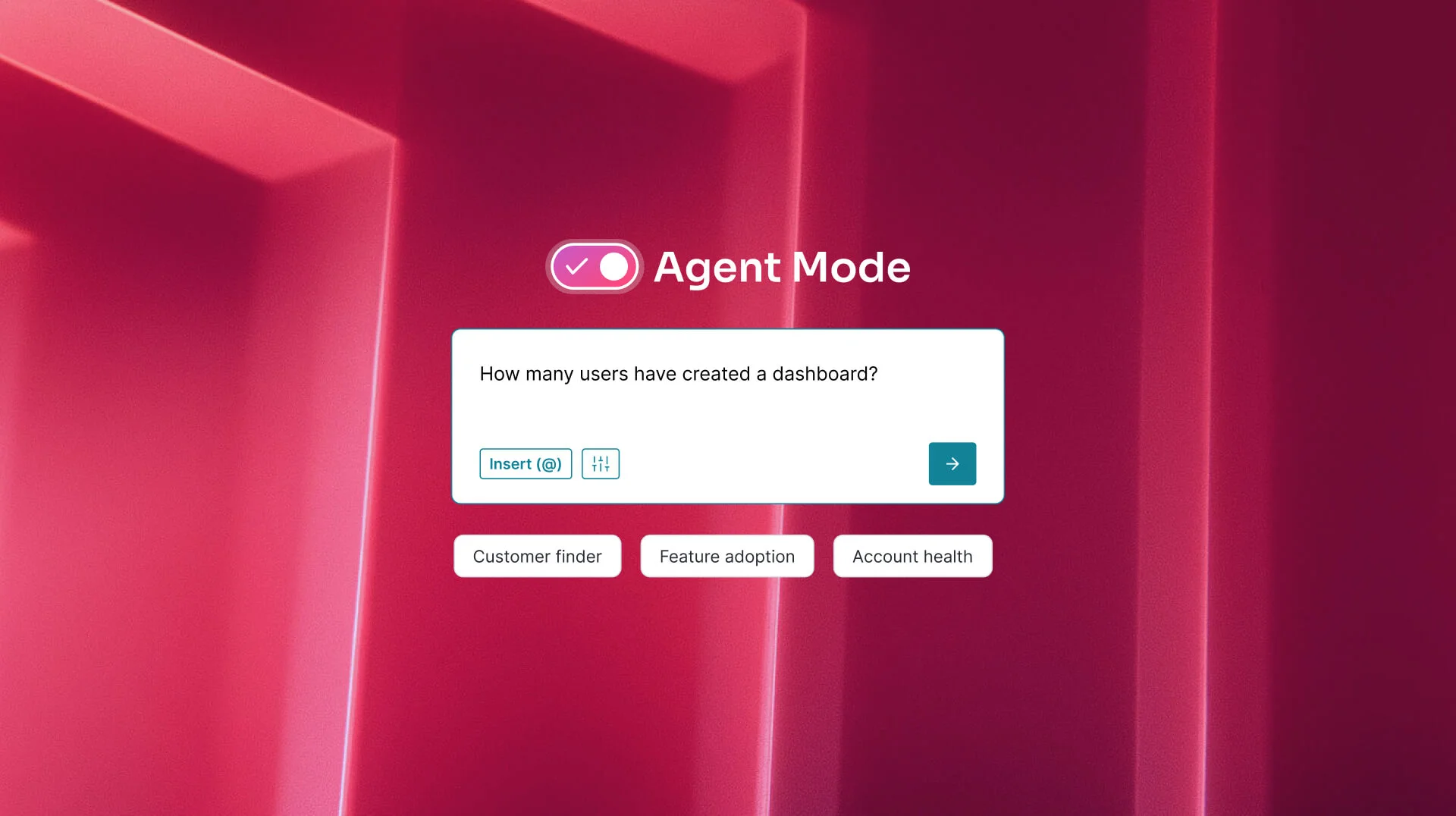

See Pendo in action and learn how Pendo teams use our own product to optimize our customers' software experience.