Financial institutions face rising demand for digital banking as customers increasingly prefer the convenience of online experiences over in-person interactions at physical branches. But what does digital banking success look like? How do you best measure it?

Use these critical KPIs:

- Digital adoption and activation

- Channel-specific transaction shifts

- Device-driven customer behavior

- Retention through engagement frequency

- Customer support impact (call center)

- User satisfaction and advocacy (CSAT/NPS)

Why digital banking product analytics matters

Financial institutions must go beyond basic analytics—such as logins or pageviews—to understand exactly how users engage with banking features and services. With the right product analytics solution, banks can pinpoint the most valuable features to users, drive adoption through targeted in-app guidance, and optimize user journeys. This ultimately leads to increased satisfaction, engagement, and lifetime value.

How banks benefit from Pendo’s product analytics

Pendo’s analytics provides deep insights into workflow level, application-level, and feature-level interactions. It also gives teams user journey analysis, the ability to drive desired behavaiors via in-app messaging and contextual guidance, and the means to deploy sentiment surveys in the product itself. Banks leveraging Pendo can proactively identify friction points, enhance customer experiences, and deliver personalized interactions to boost retention and competitive advantage.

Essential KPIs for Digital Banking

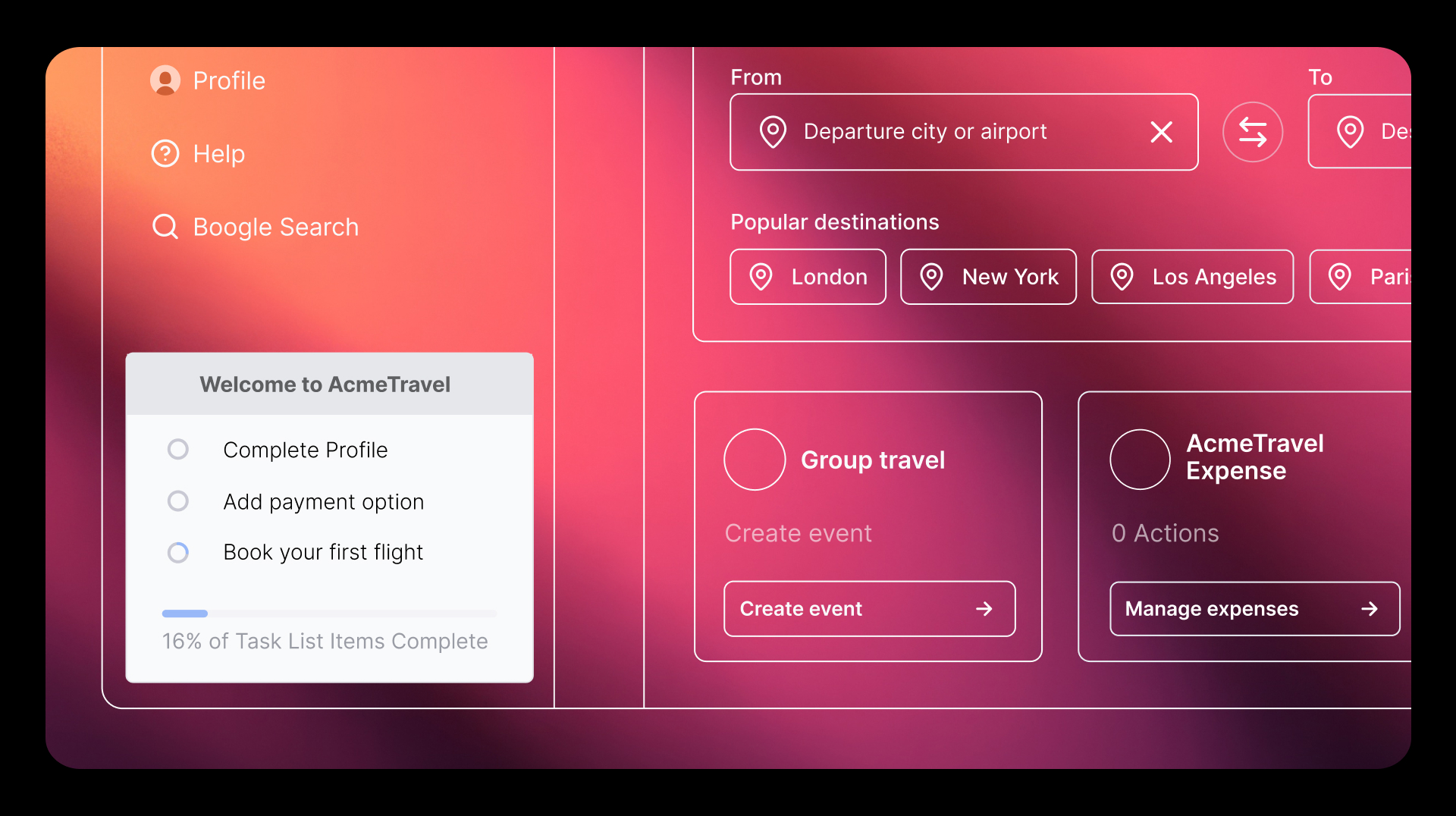

1. New account applications and activations

This KPI measures how many users complete account applications and activate their accounts (e.g., depositing funds, bill pay setup). It’s a metric thatighlights onboarding effectiveness and can identifyfriction points in account setup. Specific metrics to track include completion rates on key workflows and activation rates for key transactions (e.g., deposits).

Low activation, for example, might indicate onboarding confusion, suggesting clearer in-app guidance.

2. Transactions by channel (in-person vs. digital)

This KPI compares transaction trends between digital and physical channels, segmented by transaction types. Questions it helps answer include:

Are users shifting fully digital?

Which transactions remain in-branch?

Depending on what they see, teams can focus on optimizing underutilized features or offerings based on the data. Persistent in-branch mortgage applications, for example, could indicate a need for clearer online support.

3. Online banking logins by device

This KPI looks at daily/weekly logins segmented by desktop and mobile devices, including browser and OS types. It helps teams prioritize enhancements based on device usage and ensure the right balance of desktop and mobile. Predominantly mobile logins, for example, suggest prioritizing mobile app updates and responsive mobile designs over desktop.

4. Login frequency and user retention

This KPIracks active users daily (DAU), weekly (WAU), and monthly (MAU). It lets teams monitor user habit formation and ongoing engagement and helps them assess which features are most effective vs. which need enhancements.

A declining WAU-to-MAU ratio, for example, may indicate that users are struggling to find value in a feature, prompting targeted improvements.

5. Call center volume related to digital banking

This KPI looks at daily call volume specifically related to digital banking support. By tracking it, teams can identify digital friction causing increased support demands. From there, they can craft the right in-app messaging to fix it.

Frequent password reset calls, for example, may indicate an opportunity for automated resets and clearer in-app instructions.

6. Customer sentiment (CSAT/NPS)

It’s important for banks to regularly assess customers’ satisfaction (CSAT) and their likelihood of recommending services (NPS). This enables them to quantify satisfaction trends and identify improvement areas through qualitative feedback. Quarterly NPS surveys, for example, may highlight slow digital transaction speeds and show the need for targeted enhancements.

How Pendo tracks essential digital banking KPIs

Pendo provides comprehensive tools to track and optimize critical digital banking KPIs. Banks using Pendo gain precise visibility into feature adoption rates, detailed analytics on user journey completions, and clear insights into task success and friction points. Pendo’s robust in-app messaging capability allows banks to measure and improve message effectiveness, ensuring timely customer guidance. Additionally, built-in survey tools collect customer sentiment (NPS, CSAT), enabling banks to quickly address satisfaction issues and enhance overall user experience.