Battle of The Product Managers Part II: The SaaS Startup vs. The Global Enterprise

Table of Contents

In a rush?

Download the PDF for later

Foreword By Jake Sorofman, Pendo CMO

The story continues…

In our previous installment of Battle of the Product Managers, we explored the differences in product management styles between East Coast, West Coast, and UK companies. Based on the positive feedback we received, we realized there was an opportunity to tell another chapter in the story.

We know what you’re thinking: The sequel is never as good as the original. But in this case, we think you’ll be pleasantly surprised, because in this case, we’re telling an underdog story. In Battle of the Product Managers, Part II, instead of comparing product management styles by geography, we explore the differences in product management styles between SaaS startups and global enterprises.

Traditionally, this head-to-head matchup — startups versus enterprise — has been seen as a David versus Goliath scenario. After all, enterprise companies are typically bigger, more established in the marketplace, and have more access to capital, whereas startups are typically smaller, less established, and scrappier. However, as we’ve seen time and time again here at Pendo, these perceived “weaknesses” of startups often translate into product management advantages.

Bigger doesn’t always mean better.

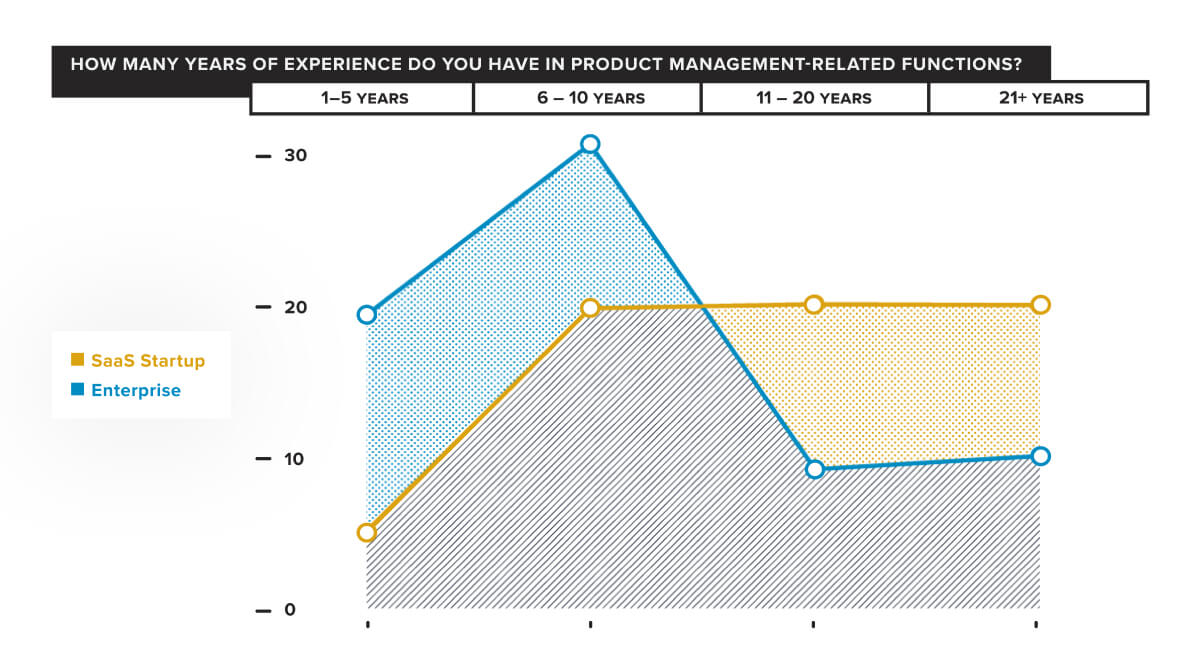

More and more, the giants are looking to the little guys for insights into how they can become leaner, drive innovation, and attract top talent. In fact, one of the most eye-opening findings from Battle of the Product Managers, Part II is that SaaS startups have been more successful at hiring experienced product leaders than their enterprise counterparts. Specifically, a whopping 62% of startup product leaders have 10+ years of product management experience, compared to just 28% of enterprise product leaders.

To clarify, we’re not saying that one type of company is necessarily better at product management than the other. The takeaway is that these two types of companies approach certain aspects of product management differently, while on balance, they’re more similar than not. Both have the same goals of building incredible products, delighting customers, and helping them become more successful. After reading this guide, we hope you’ll have a better understanding of how they accomplish these goals, so you can apply the same tactics at your company (regardless of its size).

Meet the Product Managers

Before we examine the core differences (and similarities) between SaaS startup product managers and enterprise product managers, let’s address the elephant in the room:

HOW EXACTLY DOES ONE DEFINE “SaaS STARTUP” AND “ENTERPRISE?”

The reality, of course, is that there’s no single, universally agreed-upon answer. While some base their definitions of “SaaS startup” and “enterprise” on number of employees, others base their definitions on available budget or overall valuation. At Pendo, we used survey data from our annual State of Product Leadership report to craft our own definitions, which are based on two key factors: 1) how companies sell their products and 2) how much those companies earn in annual revenue. Here’s what we came up with…

SaaS startup

A software-as-a-service provider that generates less than $100 million in annual revenue.

Enterprise

An on-premise software provider or a hybrid software provider (mix of on-premise and SaaS) or a self- identified “traditional enterprise” that generates more than $500 million in annual revenue.

As you can see, when we compare SaaS startup product managers to enterprise product managers, two distinct profiles emerge.

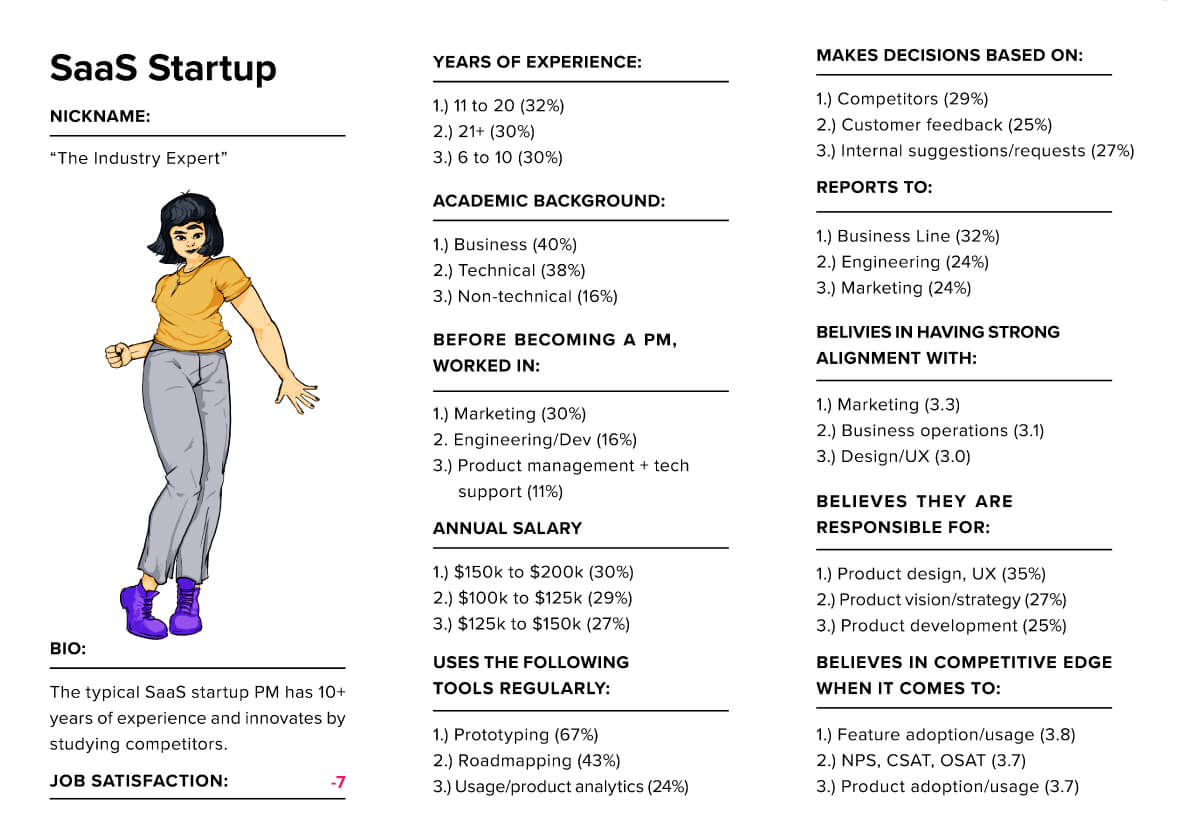

SaaS startup product managers, who we’ve dubbed “the industry experts,” have more experience overall, are more likely to come from a business background, and are more likely to source product ideas from their competitors. They also tend to have higher salaries, see themselves as having an edge when it comes to feature adoption and usage, and — from an organizational structure standpoint — they’re more likely to report to an individual line of business than to a dedicated product team.

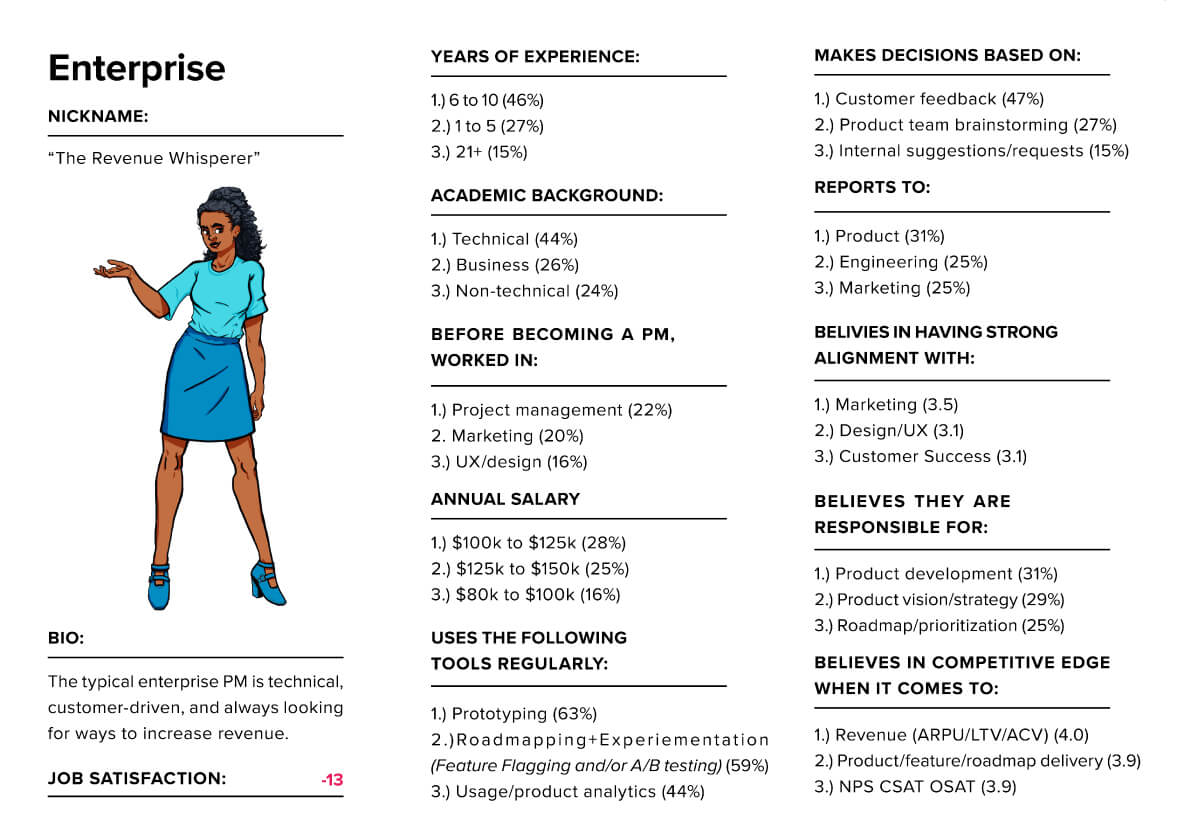

In contrast, enterprise product managers, who we’ve nicknamed “the revenue whisperers,” are more likely to come from technical backgrounds and to source product ideas from their customers. Overall, they have less product management experience, and, unfortunately, their salaries seem to reflect this, as they tend to earn less annually than their SaaS startup counterparts. Enterprise product managers see driving revenue as their biggest strong suit, and they tend to report to dedicated product teams.

While the differences between SaaS startup and enterprise product managers are plentiful, these two groups still find common ground in several areas. For example, both value having strong alignment with marketing over any other department, both use prototyping tools more regularly than any other product management tool, and — based on their abysmal job satisfaction ratings — both groups believe there is plenty of room for improvement in the field of product management.

Keep reading for a more in-depth analysis of the key differences and similarities between SaaS startup and enterprise product managers.

Please fill out the form below to read the rest of this e-book.

Where the PMs Differ the Most

- CAREER PATH

- SALARY

- DECISION MAKING

- EFFECTIVENESS

- ORGANIZATIONAL ALIGNMENT

Career Path

One of the biggest discrepancies we discovered when comparing product managers at SaaS startups to those at enterprise companies is their respective years of relevant product management experience. While SaaS product managers are most likely to have between 11 and 20 years of experience (32%), enterprise product managers are most likely to have between six and ten years of experience (46%). When you look at the broader data set, this discrepancy becomes even more telling.

At SaaS startups, the second-largest cohort — after those with between 11 and 20 years of experience — are those with 21+ years of experience (30%). Meanwhile, at enterprise companies, the second-largest cohort has even less experience than the first, with 27% having just one to five years of experience.

Of course, this begs the question: Why do SaaS startups succeed at attracting more experienced product leaders than enterprise companies – especially when enterprise companies tend to be more established and often have more resources? There’s no simple answer, but the annual salaries product managers receive at these companies (something we’ll explore in the next section) likely plays a role.

For now, let’s move on to another difference in the career paths of these two types of product managers: academic background.

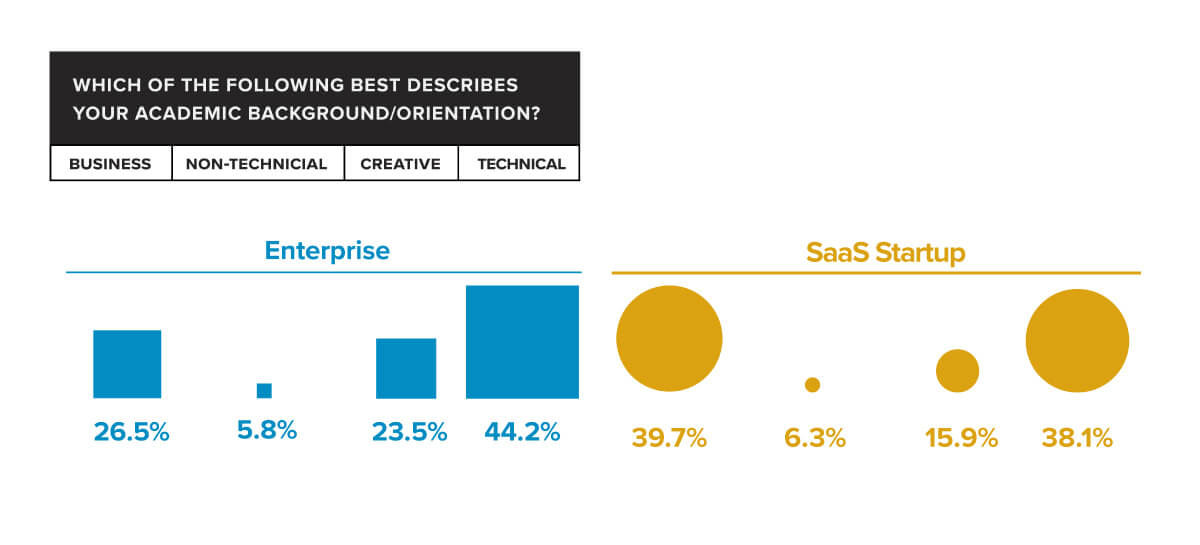

Compared to experience level, there isn’t as stark of a contrast between what SaaS startup product managers studied before starting their careers versus what enterprise product managers studied. Still, the differences that do exist help add more nuance to our characterizations. Specifically, while SaaS startup product managers are most likely to have business backgrounds (40%), enterprise product managers are most likely to have technical backgrounds (44%).

In isolation, this business/technical distinction might not mean much. But when you couple it with the fact that SaaS startup product managers are more likely to rely on competitive research when making product decisions, whereas their enterprise counterparts are more likely to rely on customer feedback, it helps paint a picture of two very different approaches to product management. One takes an outside view, focusing on the broader industry landscape; the other maintains a more inside perspective by focusing on existing customers.

Now that we’ve looked at experience level and academic background for these two types of product managers, let’s explore what roles they worked in prior to taking the product management plunge.

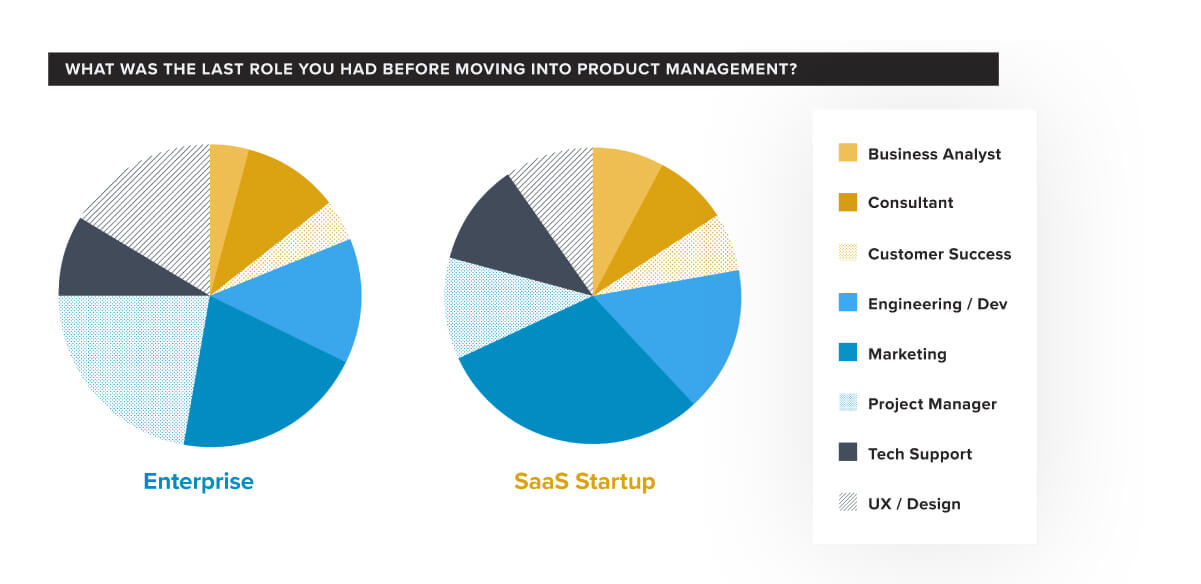

Overall, enterprise product managers have a more even distribution of past roles, with 22% having worked in project management, followed by 20% in marketing, and 16% in UX/ design. In contrast, SaaS startup product managers are more concentrated around the same past role, marketing (30%), with engineering/dev taking the second spot (16%), and project management and tech support tied for a distant third (11%).

Once again, these findings point to enterprise product managers being more “introverted” in their approach (as they’re more likely to have a background working on internal projects) and SaaS startup product managers being more “extroverted” (as they’re more likely to have a background working in marketing, which is inherently outward-facing).

Salary

As we identified in the previous section, SaaS product managers tend to have more experience than their enterprise counterparts. Specifically, while the former are most likely to have between 11 and 20 years of experience (32%), the latter are most likely to have between six and ten years of experience (46%). And when we look at the next tier down, the story doesn’t get any better for the enterprise:

Their second largest cohort (27% of product managers) has just one to five years of experience, while the second biggest cohort for SaaS startups (30%) has 21+ years of experience.

So, how do we account for this discrepancy? Or, to put it another way, why are SaaS startups so much more successful at attracting experienced product managers? It’s likely not the only factor at play, but it’s clear from the data that salary has something to do with it.

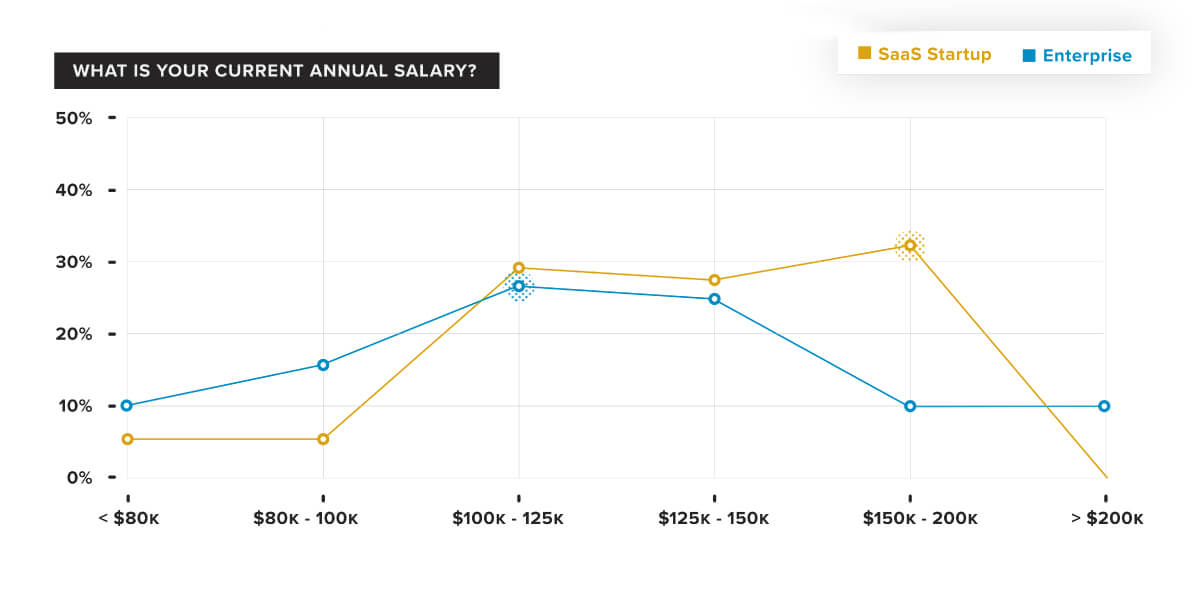

At SaaS startups, the largest cohort of product managers (30%) earns between $150,000 and $200,000, the second-largest cohort (29%) makes between $100,000 and $125,000, and the third-largest cohort (27%) makes between $125 and $150k. Compare this to enterprise companies, where the largest cohort of product managers (28%) makes between $100,000 and $125,000 the second-largest cohort (25%) makes between $125,000 and $150,000, and the third-largest cohort (16%) makes between $80,000 and $100,000.

Based on these salary distributions, it seems clear that SaaS companies are investing more in attracting talent, possibly to adjust for the increased risks associated with startup careers. That being said, it’s worth noting that enterprise companies actually have more product managers at the very top of the salary pyramid, with 10% making more than $200,000 — compared to just 2% of SaaS startup product managers. However, if the goal is to attract lots of people who are highly experienced, enterprise companies might do better to follow the SaaS startup approach and spread more of that money down to the $150,000 to $200,000 tier.

Decision Making

Contrary to popular belief, most product ideas aren’t conjured in the minds of visionary product leaders. Instead, companies search high and low for inspiration, taking both quantitative and qualitative data into account before deciding on a new product or feature. The specific sources a company turns to for inspiration say much about their approach to product development, and this turns out to be especially true when we look at the decision-making habits of product managers at SaaS startups versus enterprise companies.

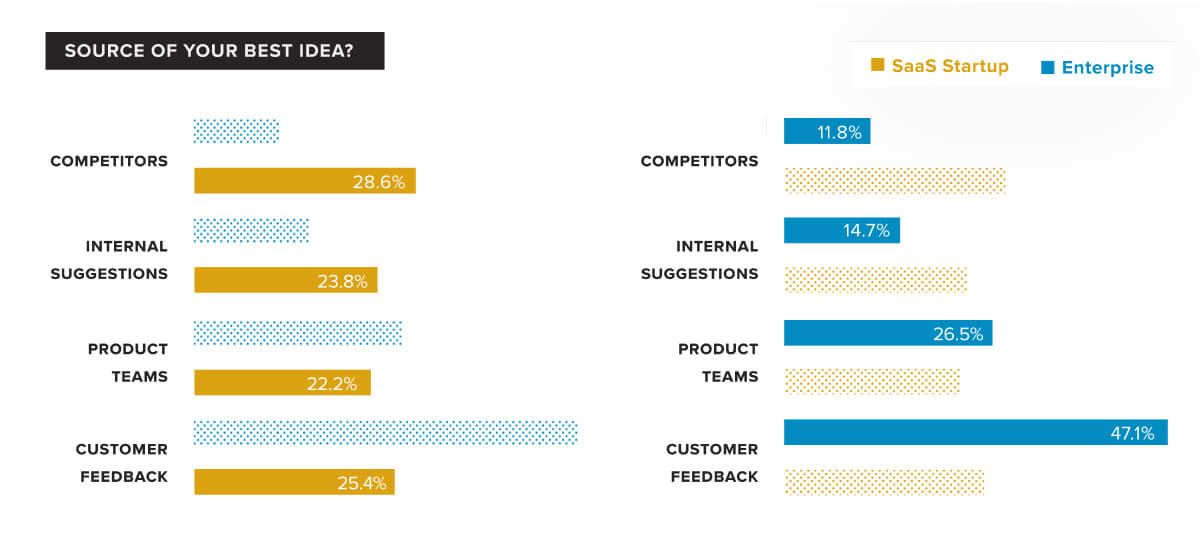

As you can see, SaaS startup product managers are most likely to source their best ideas from competitors (29%), while enterprise product managers are most likely to source their best ideas from customer feedback (47%).

Overall, product managers at SaaS startups have a more even distribution of idea sources, with their second most popular source (customer feedback) receiving 26% of responses, their third most popular source (internal suggestions/requests) receiving 24% of responses, and their fourth most popular source (product team brainstorming) receiving 22% of responses.

In contrast, there’s a more clearly established hierarchy of idea sources among enterprise product managers. Customer feedback is far and away the most important, followed by product team brainstorming (27%), then internal suggestions/ feedback (15%), and, finally, competitors (12%).

It’s particularly provocative that while competitive research is the most popular source of ideas among SaaS startup product managers, it’s the least popular source of ideas among enterprise product managers. Again, this points to two fundamentally different approaches to product development: one that’s externally focused (startups) and one that’s internally focused (enterprise).

Effectiveness

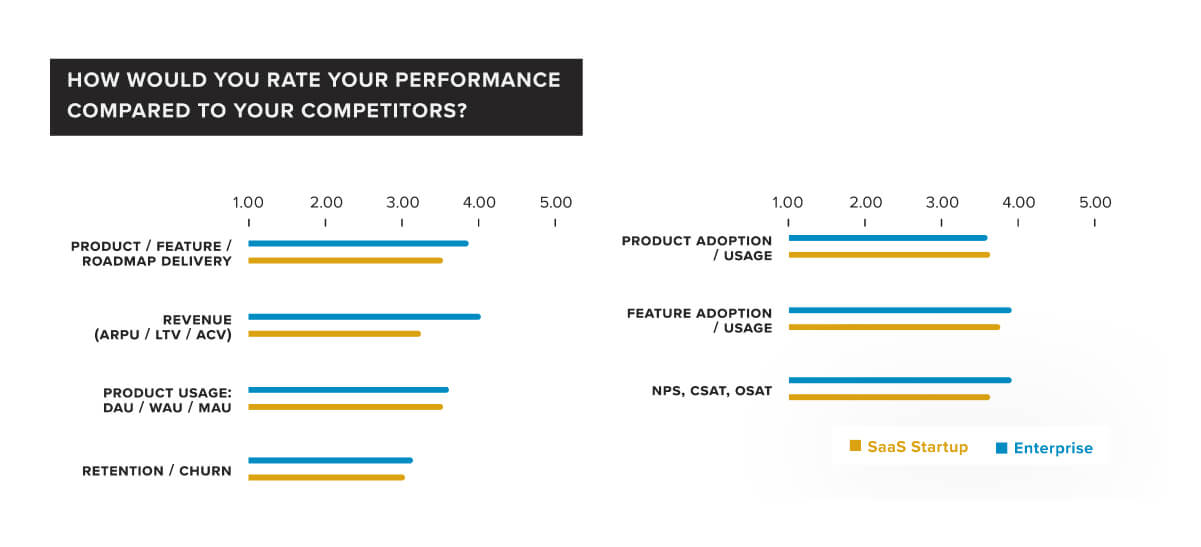

In Pendo’s State of Product Leadership report, we asked product managers to score their effectiveness in different categories on a scale from 1 to 5, where 1 = underperforming competitors and 5 = outperforming competitors. When we segmented these results by company type (SaaS startup vs. enterprise), a few key differences emerged.

For starters, SaaS startup product managers believe that the number one advantage they have over competitors is driving feature adoption/usage (3.8 out of 5). In contrast, enterprise product managers believe that their top advantage is driving revenue (4.0 out of 5), specifically average revenue per user (ARPU), customer lifetime value (LTV), and annual contract value (ACV).

The second biggest advantage SaaS startup product managers believe they have over competitors — giving it a score of 3.7 — is receiving high marks on Net Promoter Score (NPS), customer satisfaction (CSAT), and overall satisfaction (OSAT) surveys. In contrast, enterprise product managers cited product/feature/roadmap delivery as their second biggest advantage, giving it a score of 3.9.

Taken together, these self-reported effectiveness scores reinforce the idea that enterprise product managers have an inward-looking product management style, as revenue and roadmap delivery are both internal, company-driven metrics. The scores also highlight SaaS startup product managers’ outward-looking style, as feature adoption/usage and customer satisfaction are both metrics that look at what people outside the company (i.e., customers) are doing and thinking.

The data also makes clear that enterprise product managers have a higher opinion of their own overall effectiveness. When you tally up all of the scores across all of the categories, enterprise product managers end up with a total score of 26.3, whereas their SaaS startup counterparts end up with a score of 24.7.

One final finding worth noting: Both product manager groups rated themselves as having the smallest competitive advantage in the same category: retention and churn (3.2 for enterprise and 3.0 for SaaS startup). This similarity highlights what is perhaps a universal belief for product managers: keeping customers can be harder than acquiring them.

Organizational Alignment

At companies around the world, there’s a growing trend of product teams — and product leaders — gaining more influence and independence. For example, while once a rarity, the role of chief product officer (CPO) is becoming increasingly common, as product is finally earning its seat at the executive’s table.

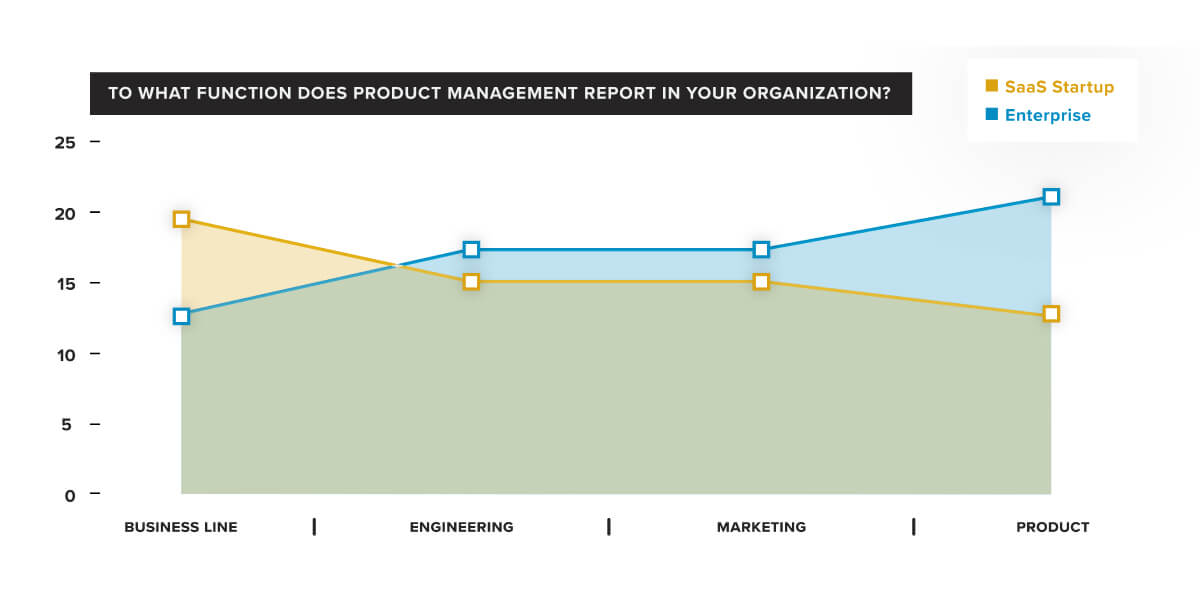

Another way to measure how “product-led” companies are is by looking at whether or not they have a dedicated product team (as opposed to having product roll up to another department). And when we look at SaaS startups and enterprise companies side-by-side, the difference is clear: Product managers at enterprise companies are most likely to report to a dedicated product team (31%), while product managers at SaaS startups are most likely to report to an individual line of business (32%).

For product managers at SaaS startups, dedicated product teams are the least common department they report to (21%), with engineering (24%) and marketing (24%) coming out ahead. For enterprise product managers, it’s the reverse: product teams are number one, and reporting to an individual line of business (19%) is the least common arrangement. Similarly, however, engineering (25%) and marketing (25%) fall in the middle of the pack.

While one might infer from these results that enterprise product managers are inherently more product-led than their SaaS startup counterparts, the reality is more nuanced — especially when you take into account the business-oriented nature of the SaaS startup product management style. By reporting into an individual line of business, SaaS startup product managers aren’t necessarily losing influence. Instead, they’re better able to tie their product goals directly to the overarching business goals of the company.

Now that we’ve seen which departments product managers from SaaS startups and enterprise companies report to, let’s take a look at how those product managers work alongside other functions.

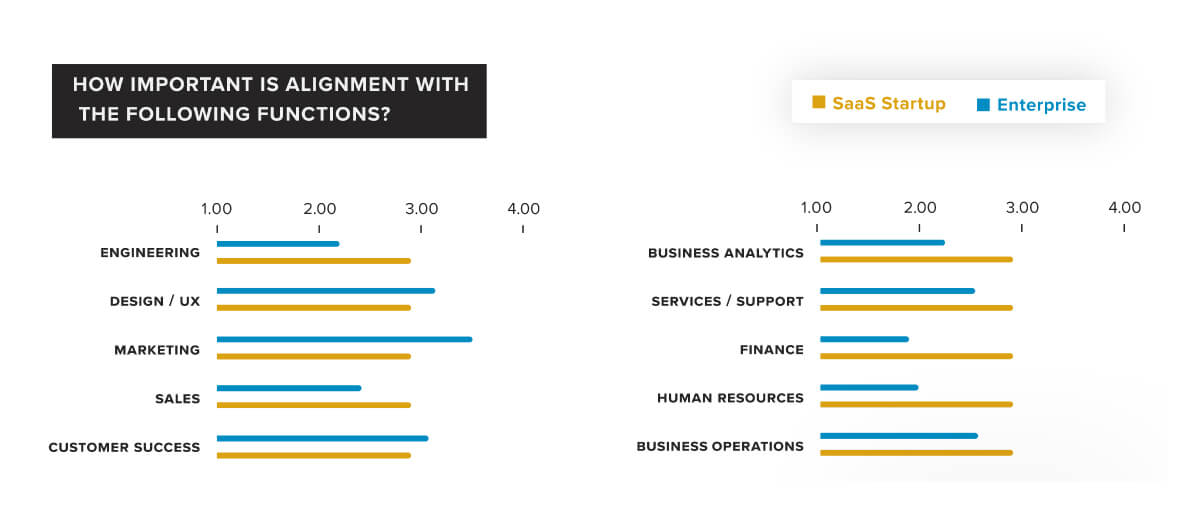

Both groups believe marketing is the most important function to be aligned with, with product managers at SaaS startups giving it a score of 3.3 out of 5 and enterprise product managers giving it a score of 3.5 out of 5.

However, while business operations (3.1) ranks as the second most important function for SaaS startup product managers, it doesn’t even crack the top three for enterprise product managers, which again points to the former group having a more business-oriented approach.

For all their differences, there are still plenty of similarities between SaaS startup and enterprise product managers. In addition to valuing alignment with marketing, both groups value alignment with design/UX and customer success nearly equally, with enterprise product managers giving both categories a score of 3.1 and SaaS startup product managers giving both categories a score of 3.0.

Now that we’ve gone through the most striking differences, keep reading to learn where enterprise and SaaS startup product managers are the most alike.

Where the PMs are the Most Similar

- RESPONSIBILITIES

- TOOLS OF THE TRADE

- JOB SATISFACTION

Responsibilities

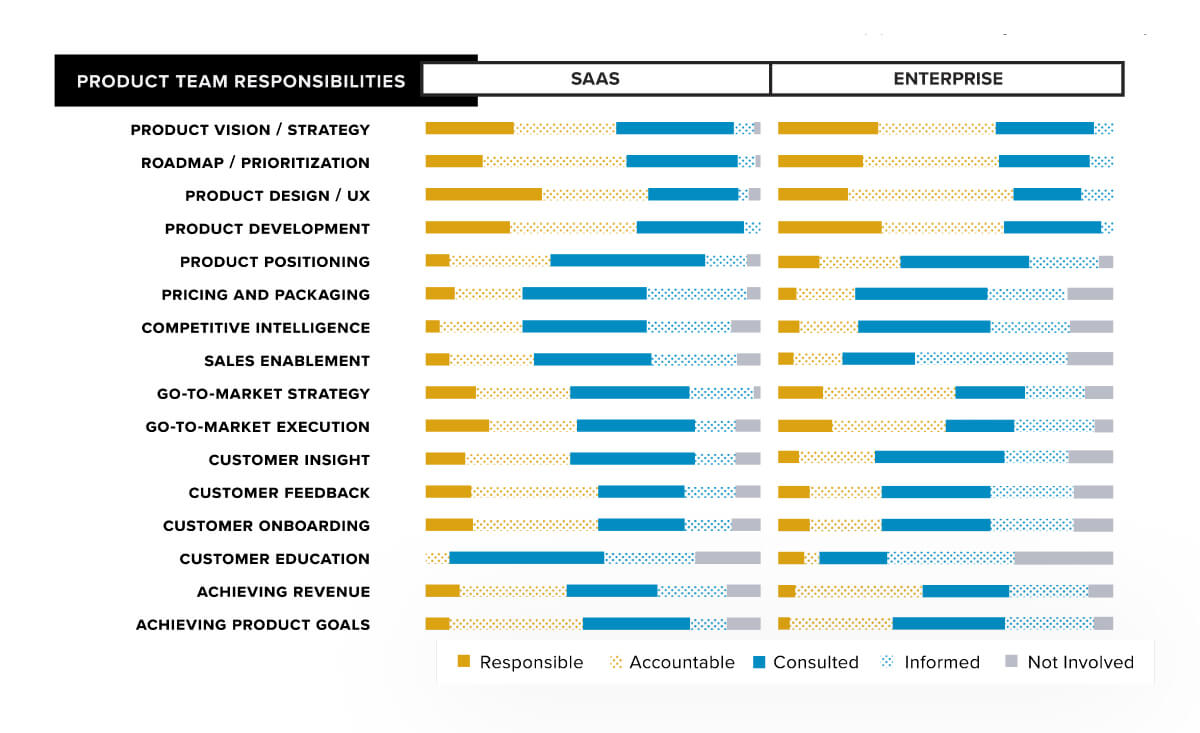

Here’s something nearly all product managers can agree on, regardless of the type or size of company they work at: product development and product vision/strategy are core responsibilities of the job.

When it comes to product development, 31% of enterprise product managers feel directly responsible (as opposed to being merely accountable, consulted, informed, or not involved), and 25% of SaaS startup product managers feel the same way. When it comes to product vision/strategy, 29% of enterprise product managers feel responsible, while 27% of SaaS startup product managers feel similarly.

This alignment around functional responsibilities echoes something Pendo CMO Jake Sorofman said at the beginning of this guide: while their approaches are different, product managers at SaaS startups and enterprise companies are still doing the same job, and trying to accomplish the same objectives.

Granted, there are a few outliers. SaaS startup product managers put a greater focus on product design/UX (35% feel responsible for it compared to 21% of enterprise product managers), while enterprise product managers put a greater focus on roadmap/prioritization (25% feel responsible for it compared to 17% of SaaS startup product managers).

Again, these differences highlight how enterprise product managers tend to care more about internal goals (i.e., are we sticking to our roadmap?), whereas SaaS startup product managers tend to care more about external goals (i.e., are people enjoying our product and finding it easy to use?).

Organizational Alignment

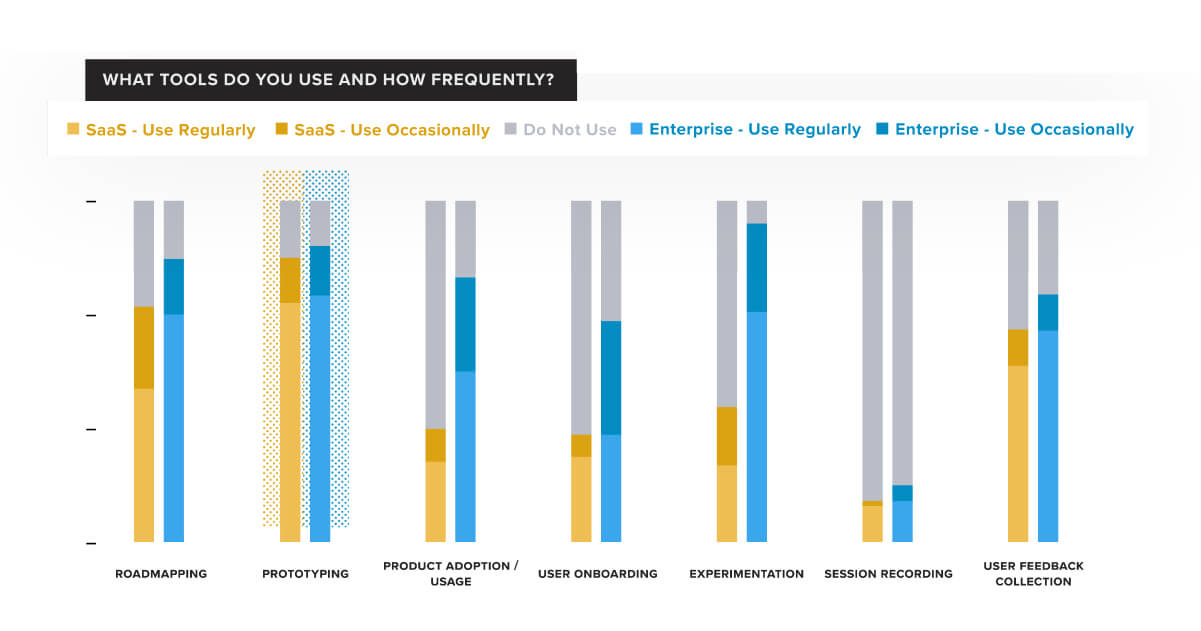

The tool usage patterns of SaaS startup and enterprise product managers are incredibly similar, which becomes especially apparent when we look at their respective “top three” lists. Both groups have the same number one tool, prototyping, with 67% of SaaS startup product managers and 63% of enterprise product managers using it regularly. The second and third most commonly used tools are also the same between groups, albeit they appear in reverse order. Number two on the list for SaaS startup product managers is user feedback collection and/or management (49%), while number three is roadmapping (43%).

For enterprise product managers, there’s a tie for the second most commonly used tool, with 59% using roadmapping tools and experimentation tools (e.g. feature flagging and/or A/B testing). User feedback collection and/or management comes in third place, with 53% of enterprise product managers using these tools.

The fact that enterprise product managers use experimentation tools more regularly than their SaaS startup counterparts (59% vs. 21%) aligns with what we learned earlier:

Enterprise product managers are more focused on driving revenue and hitting internal goals, so it makes sense that they’d spend more time trying to optimize their product in order to hit those goals.

This also explains why enterprise product managers use product analytics software more regularly (44% vs. 22%). To quantify success, they need to measure product performance.

Job Satisfaction

There’s no easy way to put this, so let’s just rip the bandage off…

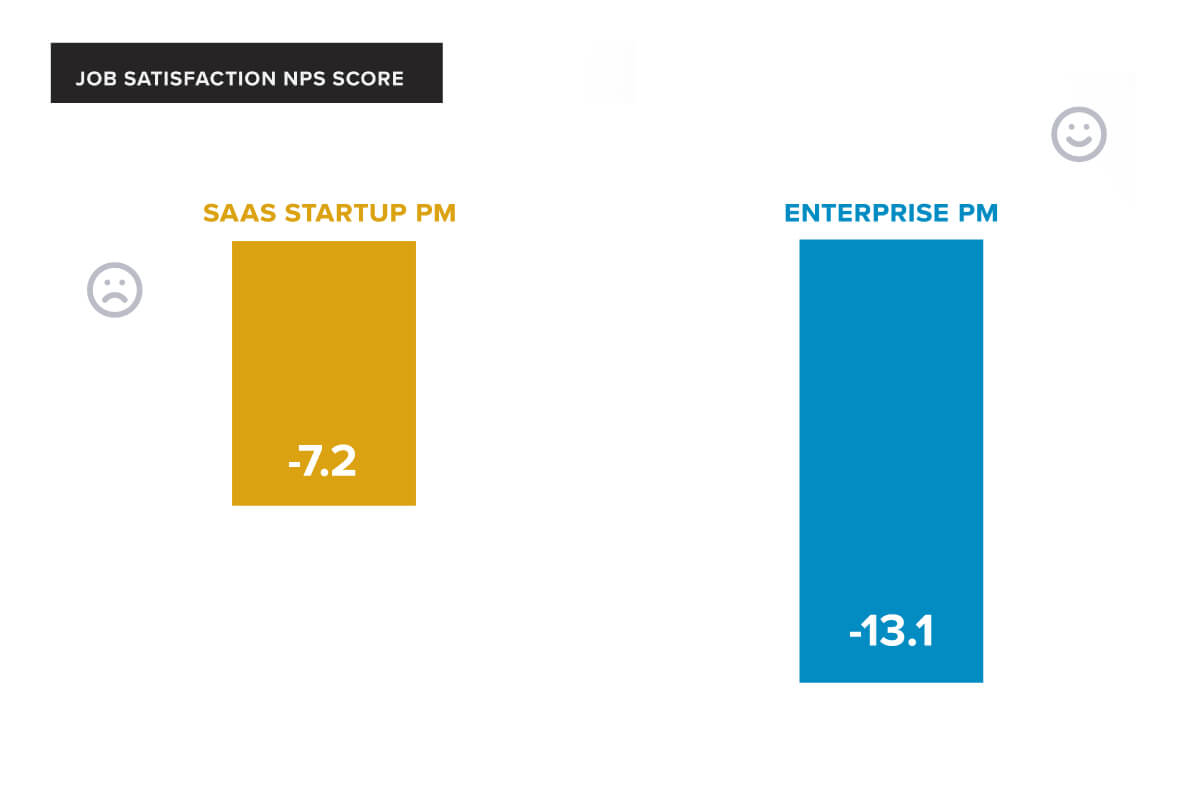

Product managers are decidedly not satisfied with their jobs, regardless of what type of company they work at — SaaS startup or enterprise.

Both groups gave the product manager role a negative Net Promoter Score (NPS), which, as you already know, is a sign that both groups are extremely dissatisfied. That being said, SaaS startup product managers are slightly more satisfied with the role (-7.2) than their enterprise counterparts (-13.1). So maybe the latter group can still stand to learn a little something from the former – but overall, the takeaway is clear:

In the field of product management, there’s lots of room for improvement.

At Pendo, we’re doing everything we can to help make the product manager role more satisfying.

Thank You

We hope this guide gave you a deeper understanding of what it means to be a product manager, and helped shine a light on the fact that bigger doesn’t always mean better.

While product managers have traditionally looked to giant, well-established enterprise companies in order to develop best practices, times are certainly changing. These days, the little guys are often the ones leading the way, and as you saw in this guide, they’re succeeding at attracting top product management talent.

Ultimately, to be a well-rounded product manager, you should look to companies of all shapes and sizes for inspiration to determine what works best for you and your team.