Pendo helps Q2 give small financial institutions the power of in-app messaging

Products used

Experience Pendo, personalized to you

Get a demoIt was a classic David versus Goliath tale for the internet age: community financial institutions and banks were struggling to compete with the online banking offerings of entrenched behemoths like Bank of America, Chase, and Wells Fargo. But Austin-based Q2 was founded on the belief that those smaller banks and credit unions deserved the same quality of software to power their own digital banking offerings.

With banks worldwide adapting to a business landscape altered by the COVID-19 pandemic, the shift to digital banking has accelerated. For community financial institutions, making that pivot—and quickly—is more important than ever. Demand is growing for Q2’s newest offering, a white-labeled version of Pendo called Q2 Discover, which lets banks create their own in-app communication, deliver it to segments of customers, and dig into usage analytics.

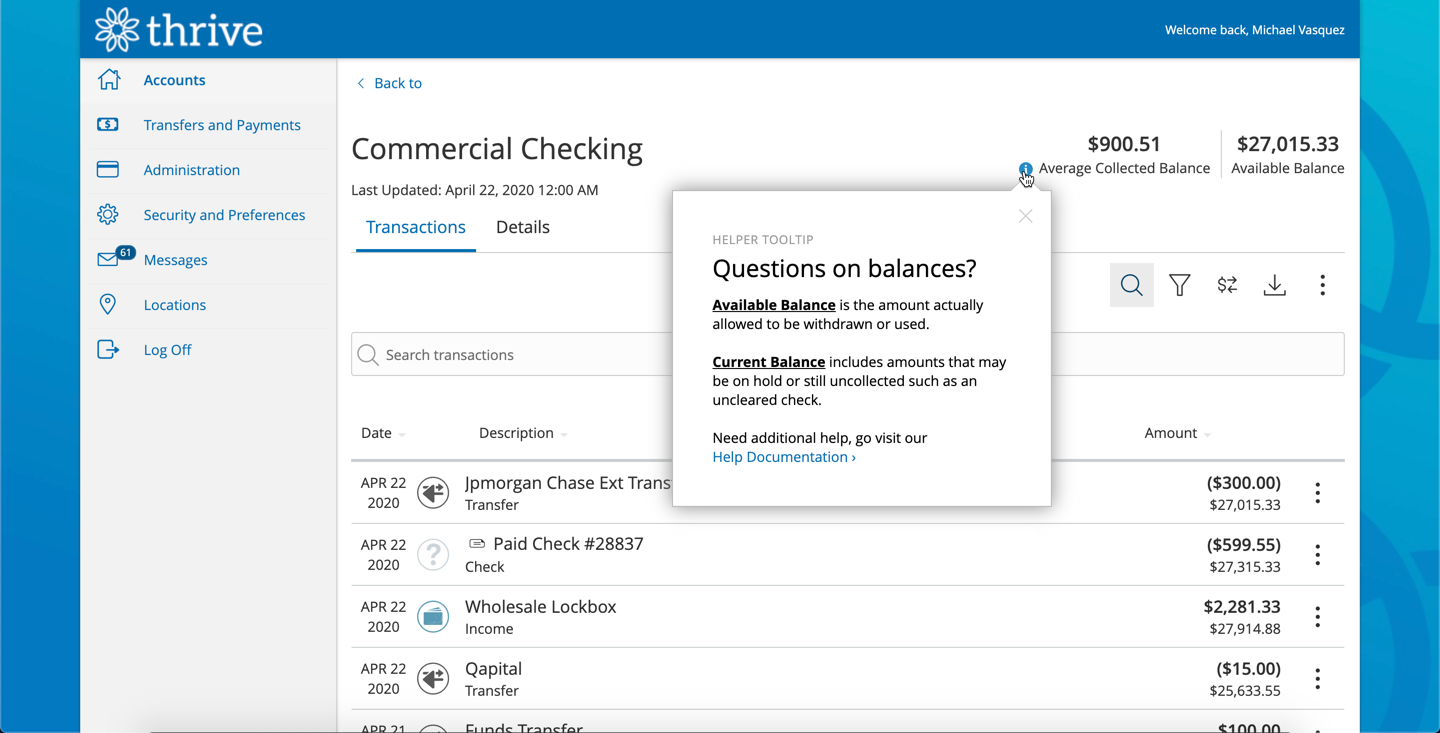

Q2 has been a Pendo customer for years, using in-app messaging and guides to onboard new users, communicate software updates, and provide self-service education and support. Walkthroughs and tooltips help bank customers locate loan applications, deposit checks, find their task documents, or understand banking terminology.

In one case, Q2 Product Owner Michael Vasquez deployed a simple tooltip explaining the difference between a user’s “current balance” and their “available balance.” That single guide was viewed 3,000 times and effectively eliminated one of the most commonly-submitted support tickets.

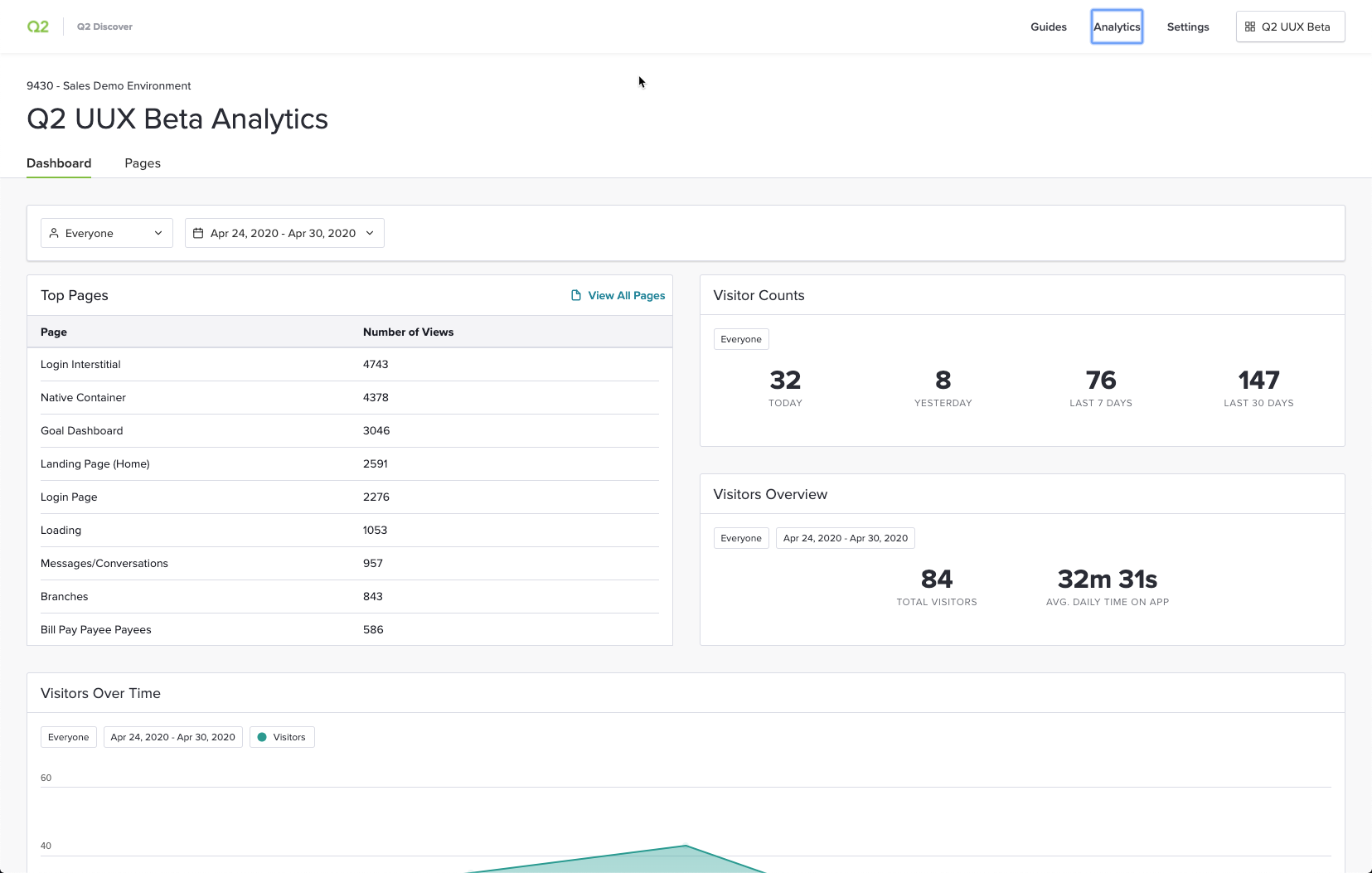

Q2’s customers noticed the impact of Pendo guides on the user experience of their platforms. Soon, they wanted the ability to see their own usage data and roll out their own guides.

“A lot of people have pivoted to the digital space, but a lot haven’t and the financial institutions are thinking things like, ‘How do we help them do a remote deposit capture by taking a picture of their checks?’” Vasquez says. It seemed obvious to use Pendo for that, but there were challenges.

The financial industry is highly regulated, and Vasquez knew he couldn’t give customers access to Q2’s Pendo analytics or guides and remain compliant. A mistake as simple as forgetting to change the segment of users that see a guide could show one bank’s banner message across the apps of every Q2 customer, not to mention giving financial institutions access to competitor data. Nor did Vasquez have the bandwidth to build guides for each individual bank.

Q2 Discover made it possible for Vasquez to equip these banks with Pendo functionality.

Q2 Discover leverages Q2’s usage data but places each individual customer in their own siloed, white-labeled instance. That way, financial institutions only have access to their own users in the system, and there’s no chance of a system-wide error or data privacy issues. They’re able to use their own usage data to build segments of users. They can display tailored in-app messages, deliver tooltip guides to drive usage of parts of the product, notify customers of new product offerings, and onboard new users with bank-specific content.

Below, see an example of what Q2 Discover looks like for a bank account holder, and what the backend looks like for the bank using the product.

For Vasquez, Pendo has provided the ability to meet the evolving needs of Q2 customers. “Our customers have been clamoring for the capability to deploy messages, and they’ve been wanting to understand the usage of their navigation,” Vasquez says. “With [Pendo], I don’t have to worry about someone going to set up something in the API and accidentally putting in the wrong financial institution number.”